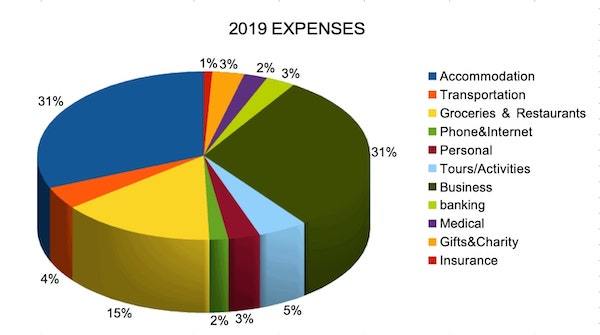

This year’s breakdown isn’t exactly a full-time travel expense report, as has traditionally been the case when I started publishing these annual reviews in 2010. Instead, it’s a picture of a location independent life – which can (and did, in this case) include the costs of maintaining a home base while also traveling the world extensively.

Being location independent means having a career that is independent of needing to be in any specific location in the world; but it doesn’t preclude having a (part-time or full-time) home. That is a lifestyle choice, and there are many location independent entrepreneurs and employees who don’t travel at all.

See also: How to Go Location Independent

Thus, this is not a travel budget – it’s a life budget and full picture of my lifestyle, including all my expenses: business, personal, travel, and otherwise.

Since 2010, I’ve published my full-time travel expenses annually; an uncensored breakdown of all my expenses for the year, demonstrating that the travel lifestyle is much more achievable than most people think. (At the end of this article you’ll find links to full-time travel expense reports from previous years).

2019 Overview

2019 was a change of pace after 12 years of full-time travel. For the entire year, I had (and was financially bound to maintain) an apartment in Toronto, along with the accoutrements of “home life” like utilities and internet and home insurance.

Still, on the whole I was happy to learn that all those years on the road helped me to approach my new home with minimalism in mind. I don’t have any belongings or services that are superfluous (to me) – like cable tv, a telephone land line, or even a cell phone plan. (Here’s how I pay almost nothing for my cell phone needs around the world).

Here’s a breakdown of where I went in 2019, which includes six countries and whole lotta bouncing around in Canada and the U.S.:

- January: Florida, Guatemala

- February: Guatemala

- March: Florida

- April/May: Toronto

- June: Toronto, Boston

- July/August: Toronto

- September: Toronto, Montana

- October: Toronto, Newfoundland

- November: Toronto, Poland, Latvia, Finland

- December: Florida

For more about my 2019 travels, see Redefining My Travels in 2019: Where I Went

Are you curious to see if my expenses skyrocketed now that I have a home base (in an expensive city in an expensive country) while also traveling half the year? I’ll admit, I wasn’t sure how it would go, and this report was as illuminating for me as I hope it will be for you.

What I Spent in 2018: $34,881

At the end of this post, I’ll summarize the year in terms of how it went financially as compared to other years. In the meantime, I feel it’s necessary to emphasize (as I do each year) that this is not a competition. I’m not out there to win a prize for spending the least (or most) amount of money on travel.

I’m not a budget traveler. Nor do I need to be; my 2019 income was considerably higher than it has ever been, which gave me freedom to spend more money. Ironically, frugality runs deep in my veins, so regardless of having a higher overall cost of living given my home base, I still waaaaay underspent in comparison to my income. (I invested the difference in long-term savings; See also: Asset Allocation for Travelers)

If you clicked on this post hoping to learn exactly how much this lifestyle costs so you can create your own travel budget, I suggest you check out this article: How to Create a Long-Term Travel Budget: Financially Sustainable Travel

Okay. So hopefully I’ve now alleviated the possibility of copping attitude (as I have in previous years) for what I spent or how. I spent what I spent, and it is what it is. Observations are welcome! Judgements are best left unexpressed.

For other illustrations of location independent finances, check out my Financial Case Study series. There, you’ll discover people earning and living on anything from four to seven figures a year.

Monthly Breakdown

All amounts have been converted to U.S. Dollars for ease of comparison.

JANUARY (Florida, Guatemala)

$3,473

I rang in the year at my friend’s place in Florida; a familiar haunt and also a free place to stay. Shortly thereafter, I went to Guatemala.

My accommodation expenses for the month were actually super reasonable since they included not only my Toronto rent, but also a hotel in Antigua Guatemala.

For the first half of 2019 you’ll also notice some pretty hefty business expenses; a chunk of that is trailing payments that I made to my SEO consultant, who I had been working with on a profit-sharing basis (an agreement that included a decreasing share of profits for six months after we stopped working together). I also hired a Pinterest consultant to get my (formerly non-existent) Pinterest account started and going. Follow me on Pinterest here!

- Accommodation $1,256

- Transportation $179

- Groceries & Restaurants $445

- Phone&Internet $107

- Personal $32

- Tours/Activities $51

- Business $1,275

- Banking $94

- Medical $15

- Gifts&Charity $19

FEBRUARY (Guatemala)

$2,682

Antigua was lovely, but Guatemala on the whole was a bit of a shit show for me, especially on arrival to Panajachel. When boiled down to brass tacks, the harsh reality was that I just wasn’t into travel at the time; I had no energy for navigating foreign environments. This means I didn’t take advantage of staying in Panajachel as a base for exploring the Lake Atitlan area in general, which is a shame.

See also: 7 Travel Mistakes I Made in Guatemala

On the upside, it also means I spent very little money. My business expenses surpassed all others, again due to the profit-sharing arrangement and Pinterest consultant (as well as my virtual assistant, but she is comparatively inexpensive).

Note: Accommodation expenses this month don’t reflect the place in Panajachel, which was prepaid in November of 2018.

- Accommodation $796

- Transportation $5

- Groceries & Restaurants $374

- Phone&Internet $43

- Business $1,164

- Banking $39

- Gifts&Charity $261

MARCH (Florida)

$2,431

Retreating to Florida for March was a good move for me emotionally and physically, and also financially! The transportation expense is my flight back to Toronto at the end of the month. Aside from that, all other expenses were about as low as they can get (even my business expenses were kept under $1,000).

- Accommodation $794

- Transportation $179

- Groceries & Restaurants $335

- Phone&Internet $42

- Tours/Activities $43

- Business $977

- Banking $50

- Gifts&Charity $11

APRIL (Toronto)

$3,203

There’s not much to remark upon from an cost perspective in April. I spared little expense in restocking my apartment with groceries and also going out for coffees and meals with friends and family, hence the uptick in food-releated expenses as well as tours/activities (which included going to a couple of shows and events with friends).

If you subtract the $1,300 I had in business expenses, I actually didn’t spend that much…

- Accommodation $788

- Transportation $45

- Groceries & Restaurants $506

- Phone&Internet $42

- Personal $39

- Tours/Activities $175

- Business $1,283

- Banking $29

- Medical $119

- Gifts&Charity $177

MAY (Toronto)

$2,470

Business expenses aside, what you see here is basically the cost of a comfortable life (for me) in Toronto. The banking expenses are a bit high for the month; it’s made up of a credit card annual fee plus some PayPal charges for a substantial affiliate payment that I received.

See also: Overhead Costs for Location Independent Businesses

- Accommodation $795

- Transportation $45

- Groceries & Restaurants $403

- Phone&Internet $42

- Personal $101

- Tours/Activities $83

- Business $640

- Banking $205

- Medical $75

- Gifts&Charity $81

JUNE (Toronto, Boston)

$4,355

Given that I attended TravelCon in Boston (a travel media conference at which I’m speaking this year in New Orleans – use discount code SPEAKER50 for a discount), I kept my food and activities expenses reasonable. The most uncharacteristic of expenses this month came in the Gifts & Charity category, which includes a special father’s day meal as well as my annual dues for Rotary (I am a long-standing Rotarian, pre-dating my travel career, and I’ve enjoyed reconnecting with my club in Toronto after a 12-year absence). The biggest expense of the month (by far) was my annual website managed hosting package, which costs a pretty penny but includes a whole set of services that help me focus my time somewhere other than the technical back end functions of my website.

- Accommodation $781

- Transportation $104

- Groceries & Restaurants $495

- Phone&Internet $153

- Personal $81

- Tours/Activities $287

- Business $1,778

- Banking $117

- Medical $118

- Gifts&Charity $441

JULY (Toronto)

$2,306

By July I was finally free of the trailing profit-sharing payment scheme I’d worked out with my SEO consultant, though I did hire out a couple of freelance projects, in addition to the work my virtual assistant does for me. For the most part, the breakdown below is the cost of enjoying summer in the city of Toronto.

- Accommodation $814

- Transportation $50

- Groceries & Restaurants $489

- Phone&Internet $43

- Personal $185

- Tours/Activities $244

- Business $348

- Banking $65

- Medical $61

- Gifts&Charity $7

AUGUST (Toronto)

$2,724

August, also a relatively sedentary month in Toronto, was a bit more expensive than July mostly due to my annual home insurance premiums being payable (which I lumped into the Accommodation category). Personal expenses are also a bit higher than usual because there was a frequent flyer mile bonus deal at one of my preferred carriers’ online shopping portals, and I’d been awaiting such a promo with a list of stuff I needed to order, and I earned a whole whack of points for my patience.

See also: My Guide to Frequent Flyer Miles and How to Travel Hack like a Pro

- Accommodation $1061

- Transportation $124

- Groceries & Restaurants $556

- Phone&Internet $51

- Personal $328

- Tours/Activities $112

- Business $256

- Banking $66

- Medical $155

- Gifts&Charity $15

SEPTEMBER (Toronto, Montana)

$1,805

September was my cheapest month of the year, due in large part to my being in Montana for almost two weeks, most of which was paid for. I was there to speak at the Travel Blog Exchange conference, which was followed by a press trip around southern Montana. Montana was great! But wow – there were a lotta checkered flannel shirts in some places. Just saying.

See also: My Adventures in Montana and Yellowstone

- Accommodation $857

- Transportation $86

- Groceries & Restaurants $429

- Phone&Internet $56

- Personal $43

- Tours/Activities $17

- Business $259

- Banking $38

- Gifts&Charity $30

OCTOBER (Toronto, Newfoundland)

$2,745

My best trip of the year was an expedition cruise around Newfoundland Canada, which was utterly epic. Lucky for me, I was invited on the cruise as a journalist, so it was also paid for (I love my job). Life (and life expenses) continued unabated however, including some hefty business spending in the form of a new phone and the annual renewal of my social media scheduling software. Banking includes a credit card renewal fee, and tours/activities expenses were tips and extras on the cruise.

- Accommodation $804

- Transportation $45

- Groceries & Restaurants $236

- Phone&Internet $78

- Tours/Activities $163

- Business $1,116

- Banking $164

- Medical $99

- Gifts&Charity $40

NOVEMBER (Poland, Latvia, Finland)

$4,555

November was my most expensive month of the year, but only partly because of my travels – the main attraction of which was to speak at the Women in Travel Summit in Latvia. I paid for most of my hotels with points, but I still had to shell out a few shekels. The same goes for transportation expenses; my flights in and out of Europe were largely covered by points, but I had to pay for a few extra flights plus taxes and fees on the points tickets.

It’s the business category that took the biggest hit, in the form of a new laptop (purchased through a frequent flyer mile promotion which earned me enough points to pay for my flights all over again).

Lastly, a new category for the year is insurance; throughout 2019 (except for Guatemala, which was insured and pre-paid in 2018), my trips were short enough that I could rely on the travel insurance automatically provided by my credit cards rather than buy insurance outright. The $276 in November was my travel insurance with World Nomads, to cover my planned four months away starting in December.

See also: Everything You Need to Know About Travel Insurance, Including What’s Covered on Your Credit Card

- Accommodation $956

- Transportation $400

- Groceries & Restaurants $360

- Phone&Internet $51

- Personal $229

- Tours/Activities $109

- Business $2,072

- Banking $14

- Medical $61

- Gifts&Charity $27

- Insurance $276

DECEMBER (Florida)

$2,132

Much as I hadn’t planned on returning to Florida this winter, I did so after a planned trip to Morocco fell apart, and thus I poetically completed the circle of 2019 by finishing the year where I started it. With a free place to stay, my December expenses were far from outrageous. Of note would be my flight from Toronto to Florida in the transportation category, my assistant’s holiday bonus in the business category, and a circuit training gym membership in the activities category.

- Accommodation $798

- Transportation $173

- Groceries & Restaurants $396

- Phone&Internet $46

- Tours/Activities $198

- Business $308

- Banking $77

- Medical $66

- Gifts&Charity $70

2019 Summary Notes (The Location Independent Life)

If you look at my previous expense reports (linked to below), you’ll immediately notice that 2019 was my 2nd most expensive year since I started tracking and reporting my expenses in 2010. (My most expensive year in 2013 was a generally horrific year where I was slapped with a near-fatal accident, passport & cash theft, and other incidents that caused me to hemorrhage money. Luckily, my income that year was commensurate with a large payout from an editor that I hadn’t predicted but was incredibly grateful for).

But I remember the days. I remember the days when I could get away with spending $1,000 or less in a month. The thing is, a great many things have changed since then.

First of all, after quite some effort I don’t just have a blog anymore; I have an online business, with a team of employees and lots of overhead expenses. My business expenses alone were over $11,000; that’s about 10 times more than I used to spend, but it paid off with a considerably better income.

Secondly, I maintain an apartment year-round in Toronto (an expensive city). Between rent and utilities, I pay about $10,000/year for the privilege of having a little patch of the world that I can escape to at any time (or all of the time). I love it, and I have no problem paying for it.

Lastly, when I travel, I tend to pay for accommodation now. Much as I adore the experiences I’ve had getting free accommodation around the world (hey – I saved over $100,000 in my years on the road with free digs), the trade-off with getting free accommodation is that you generally have to work for it in one way or another. Work-exchange gigs are pretty clear about work being involved (eg: volunteer for 20-30 hours a week, get a free place to stay, perhaps with meals as well). But even house-sitting can be onerous; one couple reached out to me recently offering me their home to house-sit, before detailing the twice-daily one-hour walks their little dog required (at very specific and unholy times of day I might add), as well as a regime of medication that sounded dreadful to administer. Shortly thereafter I turned down another house-sitting offer that involved being on-site every single night after 5pm for security reasons, as well as managing five animals, two of which are accomplished escape artists.

While these have been acceptable trade-offs in the past, in 2019, I frankly didn’t have the energy for it. I didn’t want to stunt my travel freedom with requirements like remaining locked inside every night, or to having to get up at 6am for an hour-long walk regardless of my desire to sleep in. I have an online business, and that’s enough of a commitment for now; so “free” accommodation requiring hours of daily labour wasn’t in the cards.

I suspect this negative slant is also the residual effects of burnout talking, since I’ve had my share of awesome free accommodation gigs that involved very little commitment. It’s important to pick and choose gigs very carefully; something I outline in my article The Creative Guide to Free or Cheap Accommodation.

So at the moment, when I travel, I find creative ways to get cheap-but-not-usually-free accommodation, using techniques like this one to get apartments for a fraction of what you’d see them listed at on sites like AirBnB. But it still means shelling out more money than I’ve spent in other years.

All that said, I did a few things right in terms of saving money on expenses, the most significant of which was starting to get really serious about frequent flyer miles. I’ve fairly consistently flown long-haul in business class for less than economy prices, but it wasn’t until I delivered a joint presentation about travel hacking with a couple of other experts, that I realized I was still operating at the most basic of levels in comparison to my colleagues.

So, I’m levelling up. Frequent flyer miles can be accumulated and redeemed for both flights and accommodation. In 2019 I started applying for more/different credit cards to help me achieve my travel hacking goals, save me money on travel expenses, and also to help me travel in style. I’ll be continuing to increase my savvy in 2020, with the help of the tools I list in the post below!

See also: The Beginner’s Guide to Frequent Flyer Miles and How to Travel Hack Like a Pro

As a final note, I think this may be my last expense report. I’ve tracked and published an entire decade of travel and location independent lifestyle expenses that have covered dozens of countries, modes of travel, and states of being. I’ve well and truly demonstrated that travel and lifestyle expenses vary by circumstance as well as individual preference; and also, that full-time travel can be more affordable than you might suspect……and if you balance your expenses with your income, full-time travel and location independent life can also be 100% financially sustainable for as long as you wish.

The “last expense report” says something, but you’re right, with a decade of data available for anyone who wants to learn you have left a great resource out there.

Thanks, Rob. I’m curious what you think I’m saying by suggesting that this is my last expense report?

Because in the last paragraph you had this (in bold), ” I think this may be my last expense report”.

Sounds like you’re a bit weary of both the travel lifestyle and of reporting on it, and looking for a change. Not taking advantage of your time in Guatemala, and your mentioning this being your last report seem to indicate that. Plus not finding the work-for-accomodation adventures appealing. You’re getting more mature, that’s what it seems like.

I’m just an occasional visitor but I enjoy your blog!

Best of luck whichever way you go.

Hi Steve,

Always interesting to get the take of an occasional reader. Thank you!

You’re right in that I didn’t take advantage of Guatemala because I was still fundamentally burned out from the year(s) prior.

Also, I had grown weary of the full-time travel lifestyle, hence getting a home base in Toronto.

But rest assured I’m not weary of travel in general nor of reporting on it, as I hope I demonstrated with articles like this one (https://www.theprofessionalhobo.com/this-is-the-best-way-to-visit-newfoundland/).

I’m currently 3 months into a 4 month trip and absolutely adoring it (and Greece, where I’m spending most of my time)….now, one year after Guatemala, after taking some time to properly recover from burnout, I’m in a much better position to enjoy life on the road once again.

Travel – and our travel styles and preferences – can change, over and over again, as I’ve noticed has been the case since adopting travel as a lifestyle back in 2006.

And indeed, my style of travel has changed and will change again, and again, and again.

By the way, Work-for-accommodation simply doesn’t work in tandem with running a full-time online business. Period. I don’t think it’s a matter of maturity; it’s a matter of not having enough hours in a day! Ha.

Besides, if I’m earning enough money to pay for accommodation, I say why not. This is one of many aspects that define Financially Sustainable Travel – it’s not budget travel; it’s balancing money in and money out to create the (evolving) lifestyle of our dreams.

Finally, to both you and Rob – regarding this being my last report….these financial reports take a monumental amount of time to produce (from gathering data to amalgamating and analyzing and then publishing it). All told, more than 40 hours, JUST for this post alone. I figure I’ve published all the data I need to prove everything I need to prove about financially sustainable travel.

Nora, I was not complaining just commenting.

40 hours! Stopping this will save you better than a whole work week, an extra week! That’s a big deal.

Nora,

This is the most comprehensive report I’ve found on traveling full time (or half the year) and also the only one I found backed up with financial data. Thank you for assembling this after reading your article I realized It is not as expensive as I thought. I am curious as to why you decided to travel only half the year and to maintain a home, maybe you explained this in your other articles, but I barely found your blog, so I did not read everything .. yet :). Your blog is addictive by the way, very inspirational and with a particular style that I really love. Good luck with the blog! I will return to read it 🙂

Hi Anca,

Thanks for visiting and commenting! To answer your question about why I now have a home base (in case you haven’t yet discovered it through the rabbit hole that is my website – ha ha), this article which I wrote in 2018 explains it best: https://www.theprofessionalhobo.com/my-epic-search-for-a-home-base/