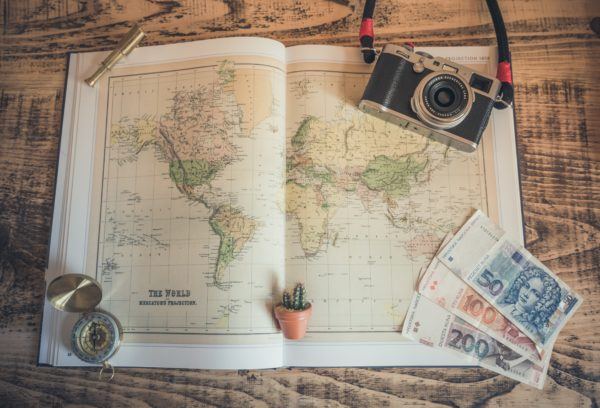

There are lots of different ways to spend money these days, but international travel throws in a whole new level of complications.

On top of managing your money, there’s transaction fees to think about, currency exchange rates, and security too.

In this guide, I’m going to outline all the best ways to travel with money, securely and safely and without losing your shirt in fees.

Table of Contents

Chapter 1: The Best Ways to Carry Cash Safely While Traveling

Chapter 2: How To Use ATMs Abroad Safely To Access Your Cash

Chapter 3: How to Use Your Debit Card Safely On The Road

Chapter 4: How to Save Money By Traveling With Credit Cards

Chapter 5: How Many Debit and Credit Cards To Carry While Traveling

Chapter 6: How to Use Prepaid Travel Cards if You Don’t Want a Credit Card

Chapter 7: The Skinny on Travelers Cheques

Chapter 1: The Best Ways to Carry Cash Safely While Traveling

Cash can be quite useful – and in some cases downright necessary – while traveling.

Despite my personal preference for using a credit card whenever I can, I’ve been to places where cash is the only currency; be it a marketplace, restaurant, or entire city or country.

But cash is also the easiest form of tender to lose or be bereft of, on levels ranging from petty to devastating.

In this chapter, you’ll learn my favorite ways to carry cash safely while you travel.

Don’t Access Your Wallet In Public

If you’re in a busy marketplace and enjoying some shopping and the art of haggling, constantly whipping out your wallet is asking for trouble.

Instead, keep some spending cash loose and separate from your wallet.

Not only is it a form of budgeting, allowing you to pre-determine how much you’d like to spend and keeping only that amount easily accessible, but it also limits your liability for theft or loss.

On a similar note, don’t keep your wallet too easily accessible. The easier it is for you to access, the easier it is for a pickpocket to access.

Diversify Your Cash

Keep some in a wallet, some in a zippered pocket, some in a shoe, and some behind in your luggage (in an unlikely place like your toiletry kit or even in a dirty sock).

That way if one stash goes missing, you haven’t lost everything.

Not only should you diversify where you carry your cash on your person, but if you’re traveling with a partner, share the load and diversify your cash between you.

Use a Money Belt (Or Hidden Pouches)

I’m not a huge fan of money belts, but I must say I’ve had a few that work better than others. In general, having a hot sweaty pouch next to my skin on travel days is uncomfortable and annoying (which may at least partially explain why I vastly prefer not to use cash, ever).

That said, there are many different kinds of hidden pouches that can be worn in various places around the body.

Keep Some Cash In Sneaky Spots

Most opportunistic thieves won’t delve so far down as to sift through your dirty laundry to see if you have some cash stashed in there. Thus, it’s a pretty good hiding place.

Another popular hiding spot for women is an emptied out tampon tube. Keep it in your pack of tampons (back in its wrapper), and an opportunistic thief isn’t likely to sift through each tampon.

Carry A Decoy Wallet

If you’re particularly nervous for your safety or are in a location rife with pickpockets, you might want to use a decoy wallet, which has a bit of cash and a bunch of fake cards that you can afford to lose should you be required to part with your wallet.

Warning: you may not want to use expired credit cards for your decoy wallet though, since it is still sensitive information you don’t want to part with.

Chapter 2: How To Use ATMs Abroad Safely To Access Your Cash

There are a few tricks to using ATMs abroad; if you don’t employ them, you might not be able to access your money while you travel.

This came to my attention when a reader hadn’t anticipated the limited access to accounts that foreign ATMs provide, and found herself without money when she needed it. It was a perfect storm of simple complications.

Here are the lessons she learned (and a few more) about using ATMs abroad, which if you heed this advice, you won’t have to learn the hard way.

Don’t Forget That Account Information And Transactions Aren’t Available On Foreign ATMs

At home, you can use the ATM to see your account information, transfer money from one account to another (such as from savings to chequing), and perform other account administration tasks.

When using ATMs abroad, this isn’t usually possible. At best you can view your balance (but not always), and make withdrawals.

Know Which Accounts Are Which

Before you go away, know which of your account numbers are linked to “chequing”, “savings”, and “other” on your ATM card.

You can normally set this at your bank before you leave. (For example, I have my main account as “chequing”, and a line of credit as my “other” account).

Sometimes in a foreign country, you can’t see the labels on the accounts, or you might not understand the language. It’s best to know your account numbers and which are which.

Get Online Banking

Access to online banking can get you out of many a pickle on the road. You can transfer money between accounts, pay bills, create travel alerts, and monitor transactions. It’s also a security measure so you can keep an eye on your accounts to ensure there’s no fraudulent activity.

My reader who was stranded abroad hadn’t set up online banking before traveling, and thus had no way of accessing the money in her savings account, which wasn’t connected to her ATM card. She had to ask somebody at home to transfer the money from her savings to her chequing account so she could make a withdrawal.

Make Sure It’s A Chip Card

It’s now the norm for both debit and credit cards to have chips and PINs. Make sure your debit card is armed with a chip, otherwise you may not be able to use some ATMs abroad at all.

Switch To A 4-Digit PIN

Many ATMs and debit machines abroad only accept 4 digit PIN numbers, so if your bank uses 5 digit PINs, make sure you switch before you depart. You can do this at your home branch, and often at home ATMs too.

If All Else Fails, Pay Your Credit Card Off

I highly discourage readers from making cash advances with their credit cards, since interest is charged on the total balance from the date of withdrawal (whereas normal credit card charges have a grace period of about a month).

But sometimes, bank cards just won’t work, and you’ll have to use your credit card to get cash.

If this happens to you, you’d do well to pay off your entire credit card balance plus the amount you wish to withdraw before you visit the ATM. This will save you from being charged hefty interest. If you can’t do this, then as soon as you can after making the ATM withdrawal, go online and pay off your entire credit card balance.

Know Your Bank’s Phone Number

If you run into problems with your bank card abroad, have your bank’s phone number handy, and register for telephone banking before you leave. It’s an alternate way to sort out account issues if you don’t have online access for whatever reason.

Registering for telephone banking is easy; simply call the banking line with your ATM card handy, and follow the prompts to set up your account and special telephone banking PIN. Telephone banking is not just for automated banking either; depending on your bank, you may need to go through this system to get to an operator who can help you.

When I was in Bali, I tried to make an ATM withdrawal at multiple ATMs without success. Luckily I had my bank’s phone number (and telephone banking PIN) on hand; when I called in, I learned that the system had flagged the ATM withdrawal as potentially fraudulent and had frozen my account. Once I confirmed that indeed it was me, they opened my account again and I could make a withdrawal right away.

Check The ATM Network Logos On Your Card

On the back of your bank card is likely a series of logos, including (hopefully) at least one of Plus, Interac, Maestro, or Cirrus, which are the most common networks around the world.

You will only be able to use ATMs abroad that display one of these logos that matches your card.

Back Up Your Information

On my trusty USB stick, I have encrypted pictures of my bank card, records of the account number on the front of my card, and my bank’s phone number in case I lose the card or need assistance.

In the spirit of redundancy (which, when you travel, isn’t really something you can overdo), I also have encrypted copies of ID and bank cards etc in my 1Password account. I can seamlessly sync all this across devices – as well as to maintain super duper secure passwords!

When my purse was stolen in Peru, I was grateful for having my ATM card number written down elsewhere, because I needed it when I called my bank to report the theft.

Know Your Withdrawal Limits

Before you leave, know the daily and weekly withdrawal limits for your account (and set your preference accordingly).

When I was in Panama, I couldn’t understand why my ATM withdrawal requests were being declined; until I remembered that I had set a low withdrawal limit before I left to prevent undue thefts if my card got into the wrong hands.

Choose An Account With Low/No Withdrawal Fees

In Peru I was getting charged $5 for every cash withdrawal at a foreign ATM, and since credit cards aren’t widely accepted in Peru and cash is king, I was losing my shirt.

Then I went online and switched from a “value” (ie: no frills) account to a higher-echelon account that allowed unlimited free foreign ATM withdrawals. I need to maintain a certain balance to avoid the monthly charge, but it’s worthwhile.

Ask your bank about any special account-types they have that limit how much you’ll be paying abroad at ATMs.

Use Bank-Affiliated ATMs

Private ATMs in convenience stores or on street corners tend to charge extra commissions and service fees, and security can also be an issue. Instead, make sure you use ATMs that are affiliated with a bank, even if it’s not your bank.

Use ATMs During Banking Hours

If the ATM eats your card, it will be considerably easier to rectify if you can walk into the associated bank right away. Because of this, it’s ideal to not only use bank-affiliated ATMs, but ATMs that are actually inside or beside the bank itself.

Check For Skimmers

After watching this terrifying video of an ATM skimmer in Vienna, I’m vigilant not only about using ATMs that are affiliated with and ideally inside major banks with security personnel on site, but I also check the ATM itself for a skimmer machine. You can do this by jiggling the device that you insert your card into (if it falls off, it’s a fake), and make sure you cover your hand completely when you enter your PIN (some machines have cameras set up to record your ATM card number and catch you entering in your PIN).

Chapter 3: Using Your Debit Card on the Road

Having a debit card means you can not only withdraw cash from ATMs around the world, but you can also pay directly for items with some vendors using direct debit.

But you’ve also got to navigate of ATM withdrawal fees (levied by both your bank and the ATM), hidden currency conversion charges, ATM accessibility options, and a myriad of security issues from having your card stolen and PIN swiped, to electronic and identity theft, to simply carrying too much cash and getting mugged.

In addition to all the ATM tips above, this chapter gives you some more info about using your debit card on the road – safely and without incurring undue fees.

Strategies to Use Your Debit Card Safely While Traveling

Limit Your Bank Account Balance

By limiting the amount of money you keep in your checking/savings account, there won’t be as much (or all) of your money there if someone steals your debit card and PIN number.

Only keep enough there to cover automatic payments (like bills or loan instalments) plus what you’d need to withdraw at an ATM one time. Keep the rest in a separate savings account not accessible through your ATM card, and do an online transfer when you need more.

Protect Your PIN Number

Stealing someone’s information isn’t always high tech.

Always be careful when entering your PIN number, whether at an ATM or at a store while making a direct debit payment. You never know when the person behind you in line – or even the cashier! – might be looking over your shoulder for your PIN.

All it takes is covering the entry pad with one hand while your other hand punches in your PIN. Easy!

Keep An Eye On Your Account

This is another reason why online banking is super handy for travelers.

If you keep an eye on your account, you’ll be able to catch fraudulent transactions sooner rather than later and alert your bank.

Fees to Be Aware of When Using Your Debit Card at an ATM

Your Home Bank’s Fees At The ATM

Your bank will probably charge you a fee each time you use a foreign ATM (unless you’re visiting a branch of your home bank).

As discussed earlier, you can often limit these fees by structuring your account to include free foreign ATM withdrawals. This may necessitate maintaining a minimum balance to eliminate monthly account fees.

Foreign ATM Fees

Many foreign ATMs charge an additional commission to use their machine. In most cases the ATM states the fee before you confirm the withdrawal.

You’ll stand the best chance of avoiding these fees by using major bank-affiliated ATMs.

Currency Conversion Fees At The ATM

Whenever you change money over from one currency to another, you’ll be incurring currency conversion fees, which are almost always hidden, and come off the top.

At an ATM, these are coming from your bank. You can find out what these fees are by reading the fine print in the terms and conditions of your bank account.

The good news is the bank is probably giving you a better deal than you can get at other places, but it’s still an additional fee to be aware of.

Fees When Paying For Purchases With Your Debit Card Directly

Instead of using an ATM, you could just pay with your debit card itself, but this might incur some of its own fees as well.

Withdrawal Fees

Depending on your bank and the type of account you have with them, they may or may not charge an additional fee when making purchases with your debit card while abroad.

This means you might be able to ask the vendor you’re purchasing from for additional cash back, and not have to pay the ATM withdrawal fees at all! Make sure you ask the vendor if they charge a fee though.

Currency Conversion Fees When Using Your Debit Card

Unfortunately there’s no avoiding this one. No matter what, when you change one currency into another, you’ll always have to pay someone something. Again, this fee will be charged by your bank, and will come off the top (and invisibly).

Chapter 4: How to Save Money By Traveling With Credit Cards

Personally, I prefer to charge everything I can to my credit card, since it provides me with records of my purchases, I get a decent conversion rate, there is a degree of theft protection, and (quite importantly) it’s a great tool for accumulating frequent flyer miles.

But credit cards are not always accepted, nor ideal, and there are a few pitfalls to beware of.

For example, cash advances should be avoided whenever possible, since interest is charged on your entire credit card balance from the day you withdraw the money (as opposed to regular charges, which afford you a grace period).

It’s also important to have the discipline and wherewithal to spend within your means, and pay off your credit card in full each month (something I manage online).

This is important, because if you don’t pay off your balance in full and on time you’ll be charged interest (not good), and ultimately it’s possible to work yourself into a financial pickle while traveling that could get ugly – especially if your credit card is your last resort.

As with so many financial matters, knowing the best option is mostly about knowing yourself.

Here’s a list of the pros and cons of using your credit card on the road.

Pros To Using Your Credit Card While Traveling

- You’ll have a detailed record of what you spent your money on.

- Currency conversion rates vary by card, but you usually find reasonable rates on credit cards.

- If your card is lost or stolen, you usually aren’t liable for the fraudulent purchases.

- You often get some travel insurance automatically for things like flight purchases and car rentals. (will link to insurance guide)

- Racking up frequent flyer miles is one of the most important secrets to my ability to fly in business class for less than the price of economy tickets.

Cons To Using Your Credit Card Abroad

Or at least things to be aware of…

- If you use your credit card at an ATM for a cash advance, be aware that interest is charged from the date you withdrew it. (You can void this by pre-paying your entire credit card balance plus your withdrawal amount before you make the withdrawal).

- While some credit cards have great currency conversion surcharges (and some even have no surcharges!), some are obscene. Make sure you do your research when you pick the card you want to travel with.

- Sometimes stores or merchants charge extra if you want to pay with a credit card, even as much as 10%.

- Don’t let your card out of your sight, and always get a receipt. In some less-than-reputable areas, merchants have been known to “double-swipe” your card or write down your card number for later.

- Sometimes merchants will offer to charge you in your home currency, but it’s not usually a good deal. A lot of times, they’re using higher conversion rates, and sometimes your bank will still charge you the foreign transaction fee (if applicable).

- Don’t use your credit card at a payphone for long-distance calls! I learned this one the hard way, trust me.

Alert Your Credit Card Company to Your Travels

It’s important to let your credit card company or bank know ahead of time that you’re going to be traveling. Many credit card companies allow you to do this online; if not, just give them a call.

If you don’t give them a heads up, and they start seeing purchases from abroad, they might freeze your card. It’s a security thing, to protect you in case someone stole your information; if this happens it can be rectified with a phone call, but can be frustrating when your card is declined.

Giving them a heads up with your itinerary before you leave will save you a lot of hassle later on. But beware: it’s not failsafe! Even with a travel alert on your account, your card may be frozen. This is why it’s good to have more than one way to pay for things (more on this later).

Don’t Have A Credit Card Yet? Apply Before You Travel

Before you quit your job to travel full-time or start your new location independent business, there’s one very important thing you should do:

Apply for any credit cards you’ll need for the road while your income is steady and stable!

A great travel strategy to ultimately subsidize your travels is to accumulate massive amounts of frequent flyer miles by strategically applying for credit cards, both before you start traveling as well as while you’re on the road.

But if your income has dropped significantly (or disappeared entirely) since you started traveling, most credit card companies aren’t going to beat a path to your door to offer you new cards.

In fact, you may find (as I did, a few years ago) that they will flat out decline you.

Career Changes and Income Drops

I was earning six figures when I decided to sell my financial planning practice to travel full-time. I also had a stellar credit rating all my life, so getting credit of any sort was always a walk in the park.

Fast forward a few years: I was up to my eyeballs in my freelance writing and travel blogging career. I wasn’t making a ton of money at it.

But it was also not a full-time endeavour, as I also volunteered in trade for my accommodation so my earnings didn’t have to be high. (Have a peek for yourself at what financially-sustainable travel can look like: here are my detailed annual income and expense reports over the years)

Self-Employed Net Income

Regardless of my ability to balance the books while traveling full-time (and even continue to save some money), my income had dropped significantly since my financial planning days.

Not only that, but because of the spectacular tax deductions I could make use of by virtue of my entire lifestyle being career-related(!) for tax purposes, my net income was practically non-existent. (See also: Filing Taxes as a Digital Nomad – Everything You Need to Know)

While this is a boon for any taxpayer, it’s not good for demonstrating income as far as the credit card companies are concerned.

So when I applied for a frequent flyer mile credit card carrying a hefty bonus, I was declined.

Declined? Fight It

If you are declined for a credit card, conventional wisdom says you can call the credit card company and ask them to reconsider their decision, often with positive results.

In my case I wasn’t successful, but I’ll also admit I probably didn’t try hard enough.

Why didn’t I try? Because I already had two lovely hand-picked reward miles credit cards that I had applied for before I sold my business and started traveling full-time; I didn’t need the card I applied for – I simply wanted it for the frequent flyer mile bonus.

Give It Time

Even if you’ve been declined, nothing is forever. If I were to apply for a credit card now (a few years after the experience I described above), I’m pretty sure I would be accepted. I have a better demonstration of income, and I continue to maintain an excellent credit rating.

Renewing Credit Cards While Traveling

How do you receive renewal credit cards when you’re traveling? Will the credit card company even honour a renewal if they know you’re abroad?

Good news: I – and many other travelers – have renewed multiple credit cards while traveling, without issue. Here are a few tips:

Check Your Renewal Date Prior to Leaving / When You’re Back for a Visit

If your credit card is close to its renewal date while you’re still in town, call your credit card company. If it’s in a certain window (often 60-90 days) before renewal, they can often manually start the renewal process early so that you can receive your new card with a fresh expiry date before you leave.

If you’re just outside that window but don’t want to bother with getting a renewal credit card while traveling, they might be able to issue you a new card right away. The downside is that it will come with a new credit card number, so any automatic payments you charge to the card will need to be amended.

Option 1: While Traveling, See if They Can Send Your Renewal Card to You

If you’re already traveling, call your credit card company two to three months prior to renewal and advise them that you’re going to be abroad when the card renews. Ask them to send the new card to your address abroad (if you have an address that can easily receive international mail, that is). Sometimes they will, sometimes not.

Caution: once you receive your renewal card, contact the credit card company again and ensure that the address they sent the card to is deleted from their records (assuming you won’t be staying there for years). I once had a renewal card sent to Australia, no problemo. At the following renewal however, no card came to my (original) Canada address. When I called to inquire, they had sent it to Australia as well! (Unbeknownst to me, they had changed my address on file to the Australian address).

Option 2: Have the Card Sent to Your “Home” Address and Forwarded

Since the Australia debacle, I tend to use this option; I simply wait for my renewal credit card to be automatically sent to my “home” address in Canada (thanks, Mum!). She then forwards it to me wherever I am. If you don’t have a willing friend or family member to act as your “home” address, a Virtual Mailing Service will do the same.

How to Avoid Credit Card Cancellation

Did you know that your credit card company can cancel your card for any number of reasons, without notifying you? And if they don’t have a reason they have a clause for that too!

Don’t get caught on the road needing to use your credit card on the road and finding out – the hard way – that it has been cancelled out from under you. Trust me – it happened to me.

Credit cards need to be managed actively, from calling in and providing travel alerts so your card isn’t frozen on the fly when you use it in a foreign country, to watching transactions closely to fend off fraudulent activity, to using it regularly to avoid cancellation for non-use.

The most common reason for your company to cancel your credit card is non-use.

It’s also really easy to avoid:

Make sure you charge something to your card every few months, and then pay it off in full at the end of every month.

This is really important if you have a credit card reserved for emergencies that doesn’t regularly get used.

Thankfully, this can be totally automated! If you have a regular payment like a subscription service, put it on that card, and then set up auto-payment in full. You can usually do this through your online banking platform for the card.

Chapter 5: How Many Debit and Credit Cards to Carry While Traveling

Juggling debit and credit cards on the road can be tricky business.

One reader wrote in:

“I’m planning a RTW trip and am having trouble wrapping my head around how to manage finances while traveling. I’ve read several blogs on this but still have two questions:

1) Is it best to carry a minimum of two cards (eg a debit and a credit or two debits etc) from different financial institutions to abate risk?

2) Is it best to keep multiple cards separate at all times? Like one on you and one in your luggage? Or does it make more sense to keep them together at different times?”

How Many Debit and Credit Cards?

I prefer to carry multiple cards to abate risk, as you say. I always have (at least) two credit cards from different banks, and one debit card. This has been handy, as I’ve frequently had minor mishaps with either one of my credit cards, and needed the second card as a backup.

Although some travelers believe in carrying multiple debit cards, I don’t bother, largely because I do most of my banking online, and I limit financial risk by keeping my bank account balance at a minimum.

Credit Card Brand Diversification

Not only do I ensure that each of my credit cards has been issued by different banks, but I also diversify my credit cards by brand; for example, Mastercard, Visa, Amex.

e not widely accepted around the world, so it’s important to have at least one Mastercard or Visa – which are the two most widely accepted credit card brands. Ironically, Amex tends to offer the best rewards cards for frequent flyer mile and rewards points collectors – but unfortunately it’s the least accepted card.

How/Where to Carry Them

The best way to carry any duplicate valuables is to separate them in case you’re bereaved of something; for example, I carry my external hard drive and laptop in separate bags, I carry cash in different places on my person and in my bags, and when I’m on the move I keep one of my credit cards stashed in my under-clothes pouch containing my trusty USB stick.

I’m pretty vigilant with this when I’m actively on the move and my bags are packed; but once I stay somewhere long enough to unpack, I tend to carry everything I need for the day in a purse or wallet.

I will admit however, that complacency bit me in the butt when I had my purse stolen in Cusco – with everything in it.

Luckily for me, I have backups of backups of backups of everything, so even losing my wallet with everything in it wasn’t catastrophic.

It’s almost impossible to hedge against all risks at all times. Generally, a nice balance of prudence and faith is the best we can do.

Chapter 6: Prepaid Travel Cards – An Alternative to Debit or Credit Cards While You Travel

Is your credit so bad that you don’t qualify for a credit card?

And/or, are you concerned about the security of having just a debit card with you, giving potential perpetrators access to all the cash in your bank account?

Or perhaps you’re worried about being subject to currency fluctuations while you’re traveling.

Prepaid travel cards present a solution to managing your money on the road if you don’t have a credit card, want fixed conversion rates, and are concerned about the security of your credit or debit card.

What are Prepaid Travel Cards?

Although they may act and look like credit cards (and many prepaid travel cards are issued by credit card companies themselves), they work on debit, not credit.

You load the card with money, then you can use it around the world at ATMs, debit machines, and anywhere you can use a credit card.

Thus your potential loss if you run into trouble (theft, etc) is never more than the value of the card.

These can be considered even more secure than using a debit or credit card because in addition to being protected by a PIN number, your prepaid travel card is not connected to your bank account in any way.

They can also be a handy way to budget. You plan your budget for a trip, load that exact amount onto the card, and you can’t spend any more than that.

Beware however: prepaid travel cards can come at a cost, with hefty fees for transactions, currency conversion, and more. I highly recommend reading the fine print for any prepaid travel card you are considering, and taking whatever measures necessary to reduce your exposure to those fees.

If you are interested in prepaid travel cards, a simple search (for “prepaid travel cards + [your country]”) will reveal your options. Make sure you read the fine print to ensure it will suit your travel needs.

Chapter 7: The Skinny on Travelers Cheques in the Twenty-First Century

Although travelers cheques used to be the most common option for traveling with currency and getting the best exchange rates with the lowest fees, they no longer are.

In fact, using travelers cheques can be a big mistake.

Even when I lived and worked at a hostel in Hawaii back in 2008, we accepted travelers cheques the (very) few times they were offered, but begrudgingly so, as they entailed more work than reward.

What are Travelers Cheques?

Travelers Cheques are pre-printed, fixed amount checks that people used to commonly use instead of cash while they traveled.

They were sold by banks to customers to use at a later time. The customer would immediately sign them as soon as they got them. Later, when paying with them, they would sign again and could use them as currency if the signatures matched.

They also came with receipts and documentation so that they could be replaced if they were lost or stolen.

The Decline of Travelers Cheques

According to Wiki, travelers cheques have been going steadily out of favour since the 1990s, with alternatives like credit cards, debit cards, and ATMs becoming more common, convenient, and cost-effective.

They also pose security risks for retailers, who would rather fork out commissions to accept credit cards instead.

Nowadays, travelers cheques are difficult to cash, even at banks.

One reader emailed me once about her experience taking travelers cheques to Europe:

“I unfortunately traveled with travelers cheques from American Express in Euros. You’d think Euros were Euros but they are not. Have not been able to cash them despite going to 12 banks. And there is no Amex office…”

Security Issues with Travelers Cheques

Travelers cheques aren’t even all that secure for travelers either.

Originally, the attractive thing about them was being able to replace them if they were lost or stolen. This led to a black market where they were sold by scammers for half the amount, and then reported stolen.

This, of course, contributed to the decline of travelers cheques and a lot of businesses stopped accepting them.

The problem for travelers whose checks were actually stolen, was that the process of getting them replaced is ridiculously complicated, and a lot of people aren’t able to even get them replaced at all! (which is of course why they got them in the first place).

At one point in time, they were a viable alternative to carrying large amounts of cash.

But these days, your cash is best left in your bank account (or travel savings account), and accessed when you need it via credit card or debit card.

Conclusion

So that’s my ultimate guide to the best ways to travel with money.

What’s been your experience with any of these strategies? Do you have any other methods you use?

Let me know by leaving a comment below!

SEE ALSO: How to Drastically Cut Your Expenses so You Can Save Money to Travel

This is a long one, a lot of good advice! Thanks!

Hey Rob,

I hope you like the long format guide!

I’m creating a few massive guides in the next few months that will clean up a plethora of smaller older posts on my site, and make the info that most people are asking for infinitely more accessible. 🙂

I like the new long format and I think it will be better for your readers though I wonder a couple of things. First, I am curious to know whether it will be better or worse for the business side of your blog (traffic, ranking, etc.). Second, I wonder if readers really will value it or not. Just because I do doesn’t mean I am typical. I have a few really long guides on my site and while they get traffic I always wonder how many people actually read them all. I suspect quite a lot maybe bookmark them for later reading, which never happens. Or they maybe start reading and get distracted and then never bother to finish.

Hi Jeff,

Great concerns! Apparently prudent SEO practice now entails the publication of much longer articles. So putting together these long guides serves to help me clean up dozens of older posts (that don’t generally get much traffic), provide updated information, AND hopefully score some extra bonus points with Google.

As for the reading of long-form guides, I do agree with you in that at times I lose patience in dedicating myself to reading a full guide. But with the chapter breakdown at the beginning (which I have on my posts, and which many people who publish guides like these use), it’s easy enough to navigate to the parts I really want to read.

Thanks for the reply and good luck with the new approach. I know you don’t post much about the art of blogging, but after you have had sufficient time applying this new long format to other topics and can judge the impact it might be interesting to post a summary of how it turns out.

Yep! You’re absolutely right, Nora. Google now favours longer content. One of my clients is now asking me to write content that’s three times the length he used to want. Google says jump and everyone seems to ask how high.

Great article, by the way. I recently opened a Transferwise Borderless account because it appears to make things a lot cheaper with currency conversions. Every time you add a currency you get an account in a country that uses it. Then you just transfer between accounts. So far, I’m impressed, but I haven’t had it long enough to evaluate all the pros and cons.

Good deal on da wallet Nora. I always use credit in developed nations. But in cash-only, 3rd world nations, I do not flash da cash LOL. All about discretion. I rarely carry much cash on me either. I just eat ATM fees and travel light.

Ryan!

Does your bank have a plan that allows you to have foreign ATM fees covered or reduced? That’s how I manage to avoid paying ridiculous withdrawal fees in cash-necessary countries.

Good information here. I first used a foreign ATM in 1995 in Paris. Now I rarely carry much cash for international travel. Instead I rely on credit cards for purchases, and ATM’s to replenish cash when necessary. The exchange rates for the cards has been much better than bank rates. You did not mention that anymore, ATM’s often offer the option of a fixed exchange rate at the time of transaction vs. the exchange rate your bank will give you. The optional fixed rates at the ATM’s I used last summer in Portugal charged 5 to 7 US cents more per Euro.

By “bank rates,” in the part reading ” The exchange rates for the cards has been much better than bank rates,” I was referring to the rate one gets changing a piece of currency at a bank, not the inter-bank rates typically used for credit or ATM transactions in my experience.

Hey Gary,

I’m glad you clarified about the “bank rates”, because in my experience, inter-bank rates (the rate you get when withdrawing cash at an ATM with your debit card) are the lowest rates.

I’ve never had an option to pay an optional fixed currency conversion rate at an ATM….personally I’d be leery.

PayPal and many credit card issuers do the same thing: you can pay a fixed (hidden) exchange rate and then the item is charge in your home currency, or you can pay whatever exchange rate is prevailing on the day the credit card posts the charge. In my experience charging in your home currency is not a good deal; they’re skimming extra in offering to convert for you!

And for the record, I do mention in the section called “Cons to Using Your Credit Card Abroad” that it’s generally a bad idea to allow the vendor to do the conversion for you and charge in your home currency.

I have seen the fixed rate offered at ATM’s in Portugal, Ireland and Mexico within the past 2 years. Those rates all turned out to be about 5% more expensive than the prevailing rate when the transaction was posted to my credit union account.

Wow – that’s fascinating! (And upsetting – ha ha)

Between some ATMs charging extra commissions (Thailand is the worst I’ve encountered at almost $10 – and they ALL charge it), to now offering fixed exchange rates (at a premium), they’re certainly making sure they “get their piece of the pie”!

Thanks Nora. We have just started a 12 month sabbatical. I travelled for many years in the 1980s with cash and travellers cheques. Our first stop has been Bali. It did not take long to see how the fees added up at the ATMs using debit cards. I figured A$5 to use the ATM to get 1,000,000 Rps (A$100) plus the currency conversion fee it ended up being 7-8% per transaction. Fortunately the 28 Degree Credit Card has provided relief from this as has cash (but there’s only so much of that one can carry). The other thing I do is only keep small amounts on my debit cards e.g. A$1000. Every week I top up the debit card account from an online account that do not have a card for. This is working well for me. Thanks for an informative post for a traveller back on the road after 25 years. Mitch

Hey Mitch,

Great strategy in limiting your debit card balance!

But beware of changing money in Bali – Bali is renowned for their currency exchange scams. Kuta in particular was a complete horror show for me (which of course made a funny – and cautionary – tale): https://www.theprofessionalhobo.com/visiting-kuta-bali/

Nora you did it again. What a thorough guide! ?

Thank you, Dane!

A couple of notes here.

I am a US ex-pat living in Hungary. Still, one of my credit cards does not have a chip in it. For those cards that do, most places around Europe no longer need you to sign a receipt when using a chip encoded credit card. In Hungary, you still do for now.

I have called my credit card companies about over-paying on my card in order to have an opportunity for a cash advance if needed. I was informed that even with a credit on the card, I would still be charged the same interest rate as any other cash advance. To solve this, I got a Charles Swab account. They reimburse all ATM fees at the end of each month.

Also, as an ex-pat, I had problems getting a pre-paid credit card even with superior credit ratings. Not living in the US or Canada sometimes has its drawbacks.

Hi Ryan,

Thanks for the intel!

There are a variety of countries (especially in Asia) that still require a signature even when they use the chip reader. I find it funny, since it usually means signing a receipt that says “no signature required”!

I don’t understand how you could possibly be charged interest on a non-existent credit card balance however…..assuming you have a $0 balance plus you overpay the amount you want to withdraw, the only charge I could imagine being possible is the withdrawal fee.

Which, thankfully, you’ve now managed to sort out with your Charles Schwab account. yay!

And don’t feel too bad about the pre-paid travel card. They’re not typically that great a deal anyway 😉

Hi Nora – thanks for such an informative post. I keep coming back to your site again and again as my travel plans advance. This time it was to find the Soctiabank Passport Visa link so that I could apply and you’d get some credit/payment for it. 🙂

Thank you so much Sherry! I’m thrilled that you use my site and content as a resource to come back to.

And even more thrilled that you got the Scotiabank Passport Visa! (Thank you so much for using my link). I hope you love it as much as I do! 🙂

Most of the people around me think that flashy hotels and expensive flights are the only way to travel and yet I use to holiday all the time and get comments like “I robbed a bank” or something. Thanks so much for sharing this, a couple of things I can look into to help me even further