How do you go about filing taxes as a digital nomad? With an ever-increasing population of digital nomads taking to the road, this is becoming an increasingly prevalent issue. And it’s not easy to figure out on your own.

The good news is, you don’t have to! Learn from experienced digital nomads in this GIANT guide with everything you need to know about filing international and local taxes.

See also: How 8 Digital Nomads Survived the Pandemic (being “homeless” and all)

Also, do you want to take your digital nomad tax game to the next level with some international tax planning strategies? Then check out my interview with Kathleen Di Paolo, who helps people with just that.

BIG IMPORTANT NOTE: I am not a tax expert. Although I’ve researched this information as best I can, it is not gospel! No part of this article constitutes tax laws and/or tax advice. Also, tax regulations vary greatly from country to country, and this information is a general guide only.

I highly advise you to seek professional counsel with an accountant or tax preparer that is familiar with the tax regulations in your country of residence. There. I am absolved. Now, enjoy this guide!

This post was originally published in 2018. It has since been updated for accuracy of links and content.

MANAGING TAX DEDUCTIONS, EXPENSES, AND INCOME

The majority of digital nomads are either entrepreneurs or freelancers. Even if you have a remote telecommuting job, if your employer has hired you as a “contract” employee (ie: without tax benefits, pension, or other employment standards act requirements), then you’ll be filing taxes as if you’re self-employed.

Although this might seem daunting if you’re new to the self-employment game, operating as a self-employed/freelancer means you can take advantage of way more tax deductions than you can as a salaried employee.

Tax Deductions for Digital Nomads

Any expense you incur in the name of earning your living is deductible – as long as you are an entrepreneur/freelancer/contract employee (as opposed to a salaried employee). For most digital nomads, this will include things like:

- Laptop, and all computer-related equipment, including laptop bags and accessories

- “Office Expenses”, like notebooks, pens, and other supplies used in your work

- Internet service

- Phone expenses, including your cell phone, as well as SIM cards and service

- Co-working space membership

- PayPal fees and other banking fees incurred in the process of getting paid (keep your fees minimal by using Wise!)

- Legal and accounting expenses

- Professional fees, including licenses or insurance you need to operate in your line of work

- Memberships and subscriptions, including association fees

- Courses or education expenses related to your field

If you have a blog or website as part of your digital nomad career, even more expenses are deductible, such as:

- Website hosting and domain fees (such as Host Gator for smaller sites, or for larger websites managed hosting like Big Scoots)

- Newsletter programs (like Aweber/MailChimp/Convertkit/BirdSend, click funnels, operating platforms (for selling digital products), and other marketing expenses

- Advertising expenses, including boosting posts on Facebook

- Blogging courses, or any educational expense incurred to help you run your business effectively

- Affiliates you pay to help you sell your products

- Employees or virtual assistants

And if you’re a travel blogger, great news! All your travel expenses are (generally) also tax-deductible!

Note: All links in the above section are to services that I have personally used and thus endorse. If you click through these links and make any purchase, I will receive a small commission, which doesn’t affect your purchase price. Thank you in advance for supporting The Professional Hobo in this way!

Tracking Expenses, Managing Receipts

Keep important records of everything as this will come in handy when you’re about to file your tax bills as a digital nomad. This requires organization and attention to detail, so don’t just shove everything in a folder or proverbial shoebox to be dealt with at the end of the year. It will take you exponentially longer to prepare your finances, and filing taxes will become a much bigger pain in the butt than it needs to be.

Here are a few different ways to manage receipts and expenses:

The Expense Spreadsheet

Until very recently when my online business got more complicated (and I signed up for Quickbooks), I just used a trusty ol’ spreadsheet to manage my expenses and receipts. Here’s my process – which you can customize (with as much or as little technology as you wish) to suit your own needs and preferences.

STEP 1: Stuff Tax-Deductible Receipts in Your Wallet

Every time you buy something on the fly that’s tax-deductible, leave that receipt in your wallet. When you’ve accumulated a few receipts in there, or at whatever pre-ordained juncture you determine (eg: weekly or monthly), pull the receipts out, and….

STEP 2: Log Your Receipts

I open my trusty expense spreadsheet and log my receipts. I log the date of the expense, store/vendor, expense category, amount, and relevant details.

As a digital nomad, it’s also important to log the currency you incurred your expense in; if you’re living the nomadic life, you’ll likely rack up expenses in a variety of different currencies. I also convert these expenses to my home currency to have a baseline understanding of my expenses.

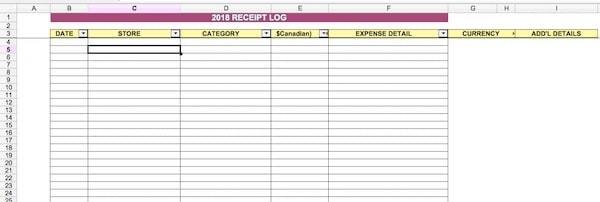

The image below is the template I use to log my receipts and track my tax-deductible expenses throughout the year:

You can also include expenses that don’t have a physical receipt (such as online payments). In these cases, log the information accordingly in the spreadsheet, and create a folder on your computer to store online receipts.

STEP 3: Store Your Receipts

If you get audited (or are proactively auditing all your outgoing costs), you’ll need to produce original receipts of your expenses. While some countries and tax authorities may accept digital images of paper receipts, I don’t leave anything to chance. I store all my original receipts as I go, by clipping them together and storing them in a plastic sleeve.

Some receipts are only ever issued electronically (with online purchases for example); in this case, I store these receipts in a folder on my computer.

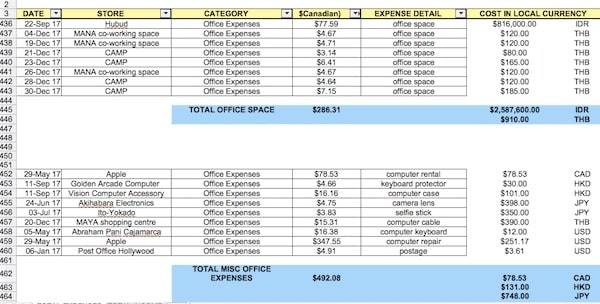

STEP 4: Organize the Spreadsheet

I prepare my expense spreadsheet by organizing all the data by category and sub-category (expense detail). I tend to break the information down quite extensively, so my tax preparer can then massage the data as they wish and input various expenses in whatever tax category works best for my situation.

As you’ll see in the below image, I also break down each expense by currency. Depending on the currency you pay for things in, fluctuations over the year can make a difference.

Some tax preparers prefer to record/file expenses in the currency incurred and use an overall conversion rate designated by the tax authorities for that tax year, while others prefer to use the pre-converted figures. I allow my tax preparer to choose by breaking it all down for them.

Alternate Expense-Tracking Methods

You don’t necessarily have to manually log all your tax-deductible expenses into a spreadsheet throughout the year. Lots of digital nomads prefer to track expenses and manage receipts digitally.

There are a variety of mobile scanning apps that utilize your smartphone camera. Other people use programs/apps like Freshbooks, Quicken, Quickbooks, or financial management software.

Some sophisticated apps even identify the relevant information from the receipts and convert it to spreadsheet format. However, this function does not generally work with foreign receipts that are in other languages and currencies.

Note: Although some digital nomads simply throw away their original receipts once they have a digital record of them, you may want to check with your tax preparer to see if the tax authorities in your country would allow digital records in the case of an audit. If they don’t, and if you can’t produce original receipts, you’ll be liable for a whole lot of extra tax payable.

Also: If you choose to store your receipts only digitally, then be sure to back everything up.

Tracking Income

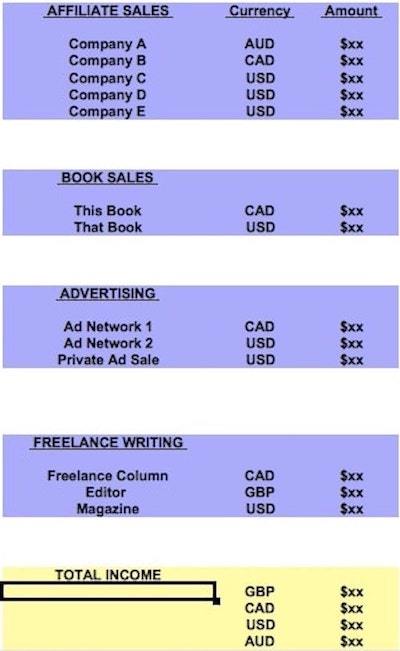

Filing taxes as a digital nomad involves more than tracking and managing tax-deductible expenses; you’ve got to track and organize your income as well!

As a self-employed digital nomad blogger and freelance writer, I get my income from dozens of different sources, from multiple countries and currencies, organized into about 10 different categories. Most of these income sources don’t send me tax slips like an employer would, and none withhold taxes. So the responsibility is mine to claim all these worldwide income sources on my tax return.

Caution! Just in case you wanted to get sneaky and omit an income source (or three), remember that some of your clients/income sources file their payments to you as deductions on their tax returns, and if you filled out a tax form for them at any point (such as a W9 or W8-BEN for U.S. payors), this income can be tracked to you, and you’ll be in trouble if audited.

What I do is manually record the following income information in a spreadsheet:

- Income Category (eg: affiliate payment, website advertising, book sales, freelance writing)

- Payor

- Date of Payment

- Currency of Payment

- Amount

I also convert payments to my home currency (Canadian dollars) for ease of understanding how much money I’ve earned.

At the end of the year, I organize all this information in a way that will be easily digestible for my tax preparer. It looks something like this:

FILING TAXES AS A DIGITAL NOMAD FROM ABROAD

When you’re living a nomadic lifestyle, more often than not, you are not going to be at home when tax time comes. Just in case you thought you could delay filing, learn from my experience:

Don’t Procrastinate

When I first started traveling full-time, I was away from Canada for two years. With very little income to speak of (and more than enough deductions), I knew I wouldn’t owe any taxes in those years so I planned to wait and file both years’ taxes when I returned to Canada for a visit.

CRA (Canada’s Revenue Agency) didn’t see it this way. 1.5 years in, they sent me a letter demanding I file the prior year’s taxes. I ignored it (knowing I’d file on my return), so they sent me another letter with a filing deadline.

I emailed my tax preparer for advice, saying I’d be back in a few months to file both years’ taxes anyway, and asked if I could ignore the letter. He said that if I didn’t file by their deadline, CRA could seize my bank accounts until I filed, since they were expecting that I owed them money and they wanted it.

Ironically when I did file (using the method below), I ended up getting thousands of dollars back. I figured that would be the end of CRA’s demanding letters so I was late in filing the following year’s tax return, only to get another demanding letter – and another tax refund of thousands when I filed. Now, even if I’m abroad, I just file my taxes anyway.

Step 1: Find an Accountant/Tax Preparer in Your Home Country

This is best accomplished before you embark on your life and career as a digital nomad, but just in case you didn’t do this, there is no need to worry. With digital nomads and ex-pats forming an ever-growing demographic on their own, more and more tax preparers and accountants are becoming experts in tax planning for digital nomads and ex-pats.

Further down in this guide, you’ll find a few suggestions depending on your country of residency, but if you want to find one yourself, simply search for something like accountant+ digital nomad + [your country of residence]. This will likely result in a list of tax firms, accountants, resource articles, and forum results where you can find recommendations.

I have a tax preparer who I’ve worked with for many years, so we have a good system going. I simply email them my spreadsheet (from wherever I am in the world at that moment), and they go to town with it. To reach this level of understanding, we had an initial consultation where they told me how best to organize my information to enable them to do the most effective job on my taxes. I highly recommend you do the same. In the consultation, you may also need to sign paperwork in advance to give them the ability to communicate with your country’s revenue agency on your behalf (for example, to access income slips or in the event of an audit).

What is the Difference Between a Tax Preparer and an Accountant?

I’m generally avoiding the use of the word “accountant” in this guide because you may not need a formally qualified accountant to satisfy your tax preparation needs. Accountants offer a higher level of expertise, along with much higher fees.

If your taxes are relatively simple, perhaps you can get away with using a tax preparer who still has sufficient expertise in filing taxes as a digital nomad, without being a fully-qualified accountant. For my first 15 or so years of being a digital nomad, my tax preparer was not an official accountant, and they did an amazing job.

Step 2A: Send Your Tax Preparer Your Income Information

Some accountants and tax preparers can (with your permission) access your income slips automatically through your country’s online tax system. These slips include not only certain employment income and payments from clients/employers in your home country, but also investment income like interest, dividends, and capital gains.

If your tax preparer doesn’t have automatic access to all these slips, then you’ll need to collect and forward them. Most institutions can generate these forms electronically, so you can likely accomplish this from abroad.

You’ll also need to send along the spreadsheet of other non-reported income and sources, as per “Tracking Income” above.

Step 2B: Send Your Tax Preparer your Expense Records

Remember that spreadsheet you labored over all year, and then further organized in preparation for filing your taxes? It’s time to send that along as well. The cleaner the records you keep, and the more clearly you itemize and break down your information, the better the chance your tax preparer will be able to kick some butt on your tax return.

Step 3: Pay Tax / Receive Your Refund

Once your tax preparer has your return ready for filing, they’ll advise you of the refund you’ll be receiving (which can be directly deposited to your bank account), or the amount of tax you’ll owe. Most banking institutions allow you to make your tax payments online.

To Incorporate or Not to Incorporate?

Lots of digital nomads choose to incorporate their online businesses, depending on the type of business they have and the income it generates. Reasons for incorporation can include limitation of liability, sheltering of income from personal taxation, types/number of customers and employees, location of the business, and even company image.

Incorporating is costly and complicated to both establish and maintain; you’ll likely need the services of an accountant and a lawyer. To determine if incorporation is a good move for you and your business, consult with a qualified accountant with expertise in your field as well as ex-pat/digital nomad tax legislation.

THE NITTY-GRITTY FOR U.S. DIGITAL NOMADS

As a former Certified Financial Planner, I get a lot of questions about filing taxes as a digital nomad. Unfortunately for many of my readers (specifically those who are based in the U.S.), I’m not familiar enough with tax legislation to advise on anything beyond the most basic of details.

Taxes for Expats

Ines Zemelman, the founder of Taxes for Expats (TFX) – a specialty tax firm that helps overseas Americans file their taxes – has shared some of her knowledge with us that you can read below.

When I saw that she had published a variety of easy-to-understand tax guides such as the U.S. Tax Guide for Digital Nomads and the U.S. Tax Guide for Retirees, I knew she’d be able to help out. Here’s what Ines had to say.

Ines, do American Digital Nomads need to file tax returns, even if they’re not located in the U.S.?

As a U.S. citizen or Green Card holder, residing anywhere in the world, you still have to file U.S. tax returns declaring your worldwide income.

What kind of taxes do Digital Nomads need to pay if they’re living and working abroad?

If you work for a foreign employer you are not required to pay U.S. self-employment taxes (Social security and Medicare). If you work for a U.S. employer, they will automatically deduct this from your salary.

However, many digital nomads are self-employed, and may be liable for SECA (Self-Employed Contributions Act) tax. Choose your destination country wisely — some countries have signed a ‘Totalization Agreement’. If you reside in a country that has signed this agreement, you are exempt from SECA tax and instead pay Social Security taxes in the country where you live.

Here is a current list of the countries that have a Totalization Agreement with the United States:

Europe: Italy, Germany, Switzerland, Belgium, UK, Sweden, Spain, France, Austria, Finland, Ireland, Luxembourg, Denmark, Slovak Republic, Norway, Greece, Czech Republic, Portugal, Netherlands, Poland

North/Central/South America: Chile, Canada

Asia/Australasia: Japan, South Korea, Australia

If the only source of income is self-employment in a country with a Totalization Agreement, please be aware that the IRS may request a Certificate of Coverage from the resident country Social Security administration.

If you are not covered in the resident country then U.S. SECA tax cannot be exempt. If you are self-employed and live in a country without a Totalization Agreement, then U.S. SECA tax must be paid, even if you paid into the Social Security system of the non-U.S. country.

However, you may still utilize this amount as ‘Foreign Tax Paid’ and use it for the calculation of the foreign tax credit. If you choose to reside in a low-tax country like Hong Kong or Singapore, this is especially important.

What is the Foreign Earned Income Exclusion (FEIE)? Does it mean Digital Nomads who earn under $100k while abroad don’t need to file taxes?

This is often misunderstood. The Foreign Earned Income Exclusion (FEIE) is the amount you can deduct from your taxable income, during filing your tax return, to reduce the tax you may owe. I.e. – if you make USD 75k, you likely don’t owe tax, but you still have to file.

If I set up a virtual address through a Virtual Mailing Service, does it make a difference which state I create my address in?

Yes! It makes a difference. You can avoid huge potential problems with the IRS and State tax authorities by choosing your state address carefully. You’ll find extensive information about this in our post: Virtual Mailbox and Why You Should Have One.

How do the Recent Tax Reform Changes Affect Digital Nomads?

The biggest changes particular to digital nomads are the corporate tax changes, which inadvertently also require individuals, who own foreign corporations, to repatriate deferred untaxed income.

We’ve written quite a bit about the recent tax reform here: Tax Reform & Expats – Winners and Losers.

One of your specialties is helping Digital Nomads and ex-pats file their taxes from abroad. What happens if they want to use your services?

Step 1: Create an account here.

Step 2: Once you sign up you will receive access to your documents as well as our Tax Questionnaire. Your answers to the questionnaire will provide us with an overview of your situation and be used to prepare your return.

Step 3: You can schedule your Free Intro 30-min Consultation!

And as a special offer to readers of The Professional Hobo, Taxes For Expats is giving new signups a $25 credit! Simply enter the code Prof_hobo when signing up.

DIY TAX TIPS FOR U.S. DIGITAL NOMADS

I’m a big fan of using the services of an expert tax preparer. One year I decided to test my ability to file a decent return (I was a Certified Financial Planner after all….it should have been easy); when my tax preparer got me an extra $3,000 back compared to my return, I gave up on preparing my tax return alone again.

But, for U.S. Digital Nomads who are keen to DIY their tax returns, here are some tips:

Foreign Earned Income Exclusion (FEIE) – As Ines said above, this income exclusion doesn’t preclude you from filing your taxes if your income is under $100k, but it does provide a lovely tax credit that will reduce/eliminate the federal tax you owe. File Form 2555 with your federal return.

Physical Presence Test / Bona Fide Residence Test – Before you can claim the FEIE you have to prove that you’re living abroad.

The Physical Presence Test involves proving that you’ve been abroad (in one or more foreign countries) for 330+ days in a year. As long as some part of that year overlaps with the tax year, you’re good.

The Bona Fide Residence Test involves proving that you’re an official resident of another country. Most Digital Nomads will fall into the former category.

Foreign Tax Credit – If you’re paying tax in another country, you get to deduct that from any U.S. taxes payable. This would be above and beyond any applicable FEIE deductions. Use Form 1116.

Foreign Account Tax Compliance Act (FATCA) – If you have more than $200k in foreign assets (not including a home in your name), then you need to declare them on your return. Use Form 8938.

Foreign Bank Account Report (FBAR) – FBAR requires you to declare assets in all foreign accounts (checking, savings, pensions, etc) if it all totals more than $10k. Use Form FinCEN 114.

Exclude Your Spouse – If you’re married to a foreigner, don’t drag them and their income into the U.S. tax system. Instead, file as “married, filing separately”.

Avoid the State Tax Trap – As Ines said above, choose your state of “residence” carefully. If your mailing address is in California, South Carolina, New Mexico, or Virginia, then even if you don’t officially live there anymore, you have to pay state taxes, until you prove that you’ll never return there again. Consider a Virtual Mailing Service to have your address in a tax-favorable state.

Seriously. Just Get Help. – Are you overwhelmed yet? I am.

Don’t leave yourself liable to an incorrect filing and subsequent penalty. Investing in a tax preparer with expertise in ex-pat and Digital Nomad tax situations will save you a bundle (of money, and aggravation) in the end.

FILING TAXES FOR CANADIAN DIGITAL NOMADS

As a Canadian, your residence status makes all the difference in terms of what your tax return is going to look like. Depending on how long you are traveling, you could be considered a factual resident, a non-resident, an emigrant, or just a plain Canadian resident. This depends on several mind-numbing factors, which you can read about on the CRA Website here.

Me? During my years abroad I was a “factual resident”, which means I maintained my Canadian residency, despite having been abroad for a dozen or so years. It means I claimed every penny of my worldwide income on my Canadian tax return. Luckily because most of my expenses are also deductions, I don’t pay much/any tax.

Some Canadian accountants recommend becoming a non-resident. It involves a special application and many (many) forms and sometimes even a “departure tax”; becoming a non-resident of Canada gets even more complicated if you own property/investments or have dependents in Canada.

However, the advantage of being a non-resident of Canada is that you don’t have to file Canadian taxes anymore! You can now set up residency in another country (if you wish), and if you’re smart, you’ll do it in a country with a zero/low-income tax rate.

I highly recommend consulting with an account that specializes in such matters before applying for non-residency, as it is a complicated procedure that may have consequences if you ever plan on returning to Canada.

Kathleen DiPaolo of Wanderers Wealth is an international tax expert who advises people on exactly these kinds of matters. Learn more about what she does here.

If you remain a resident (or factual resident) of Canada for tax purposes and you’re a DIY-er, you can file your taxes from anywhere yourself using NetFile.

Unfortunately, I can’t tell you about all the tricks and loopholes for filing Canadian taxes effectively. Why? Because I believe in outsourcing this stuff to people who do it every day. They will surely do a better job than you or I will.

But that’s just me. If you’re a DIY-er at heart, then you’ll surely be able to dig up all the information you need. Me? I’m about done with this guide. I’m going for a walk.

Canadian Tax Preparers

Here are a few Canadian tax preparers and accountants who position themselves as experts in International Tax regulations. Note: I don’t have any experience with the below firms; I advise contacting a few to see if they can help you out given your situation.

FILING TAXES FOR UK DIGITAL NOMADS

Erin and Simon of NeverEndingVoyage are from the UK and have been on the road since 2010! I asked them about filing taxes as a digital nomad from the UK. Here’s what they do:

We have to pay tax somewhere so we choose to do so in the UK as it’s our home country (and we have stayed officially resident there) and it keeps things simpler.

We are registered as self-employed in the UK which is easy to do. We also set up a partnership (again, a simple process) for the two of us which covers all our business activities. Each year we fill out a tax return online and pay any taxes (and National Insurance contributions) owed by bank transfer.

We do our tax returns—as we keep track of income and expenses each month and log it in a spreadsheet it’s easy to do at the end of the tax year. The HMRC online form does the calculation for us and tells us how much we owe.

As travel bloggers, we keep our receipts for travel expenses (we take photos of them and store them in our travel expense tracking app) for any portions of our travels where the main purpose is to research and write about the place. If we are just living somewhere for a few months or visiting friends and not writing much about the place then it doesn’t count as a work trip. This is the advice we were given by an accountant but it’s always good to get advice for your situation.

We also tax deduct the business expenses that you list here in this post.

FILING TAXES FOR AUSTRALIAN DIGITAL NOMADS

Jess and Hai are the Australian travelers behind Notes of Nomads; they have been on the road since 2006, and have spent the last few years based in Tokyo Japan. They’re on the hook to file taxes in both countries, but luckily Australia’s online tax system now makes it relatively easy.

You can select the sections that apply to you at the start and skip sections that aren’t applicable. There is help documentation you can click on along the way for clarification and you can also chat with someone directly for assistance during certain times. That’s very helpful when your situation is not so black and white, as is the case for many digital nomads.

QUESTIONS?

This guide is an evolving entity, that continues to be updated according to tax reforms, regulations, and information/opportunities available.

Did I miss something? Please let me know in the comments, or contact me privately. Let’s all help each other out.

Happy tax filing!

You Might Also be Interested in….

3 Ways for Aspiring Digital Nomads to Earn Money and Save Tax

Tax Consequences of Remote Work Visas

Financial Planning for Digital Nomads and Long Term Travelers

What a comprehensive guide to tax planning you have prepared, Nora! Thx for all the work that you’ve out into this. I’ll definitely pin for future reference. Very interesting learning about TrailWallet!

Thanks, Doreen! Filing taxes from abroad is an often asked but rarely answered question. I hope this guide will be helpful to many people!

PS – I looooooove Trail Wallet. Been using it for many years. 🙂

I am one of those odd people who actually LIKE doing their taxes! Before everyone thinks I’m crazy… I just love that I’m reporting on my money – money that a business that I started has earned. The process of getting to a point where there’s generally more money coming in than going out was a long one and so it feels great to let the powers that be know that I’m a boss.

My expense tracking receipts include giving some thoughts to your errands. Running out to buy pens on Monday and then going out again on Thursday for paper means double the receipts to track and (for those of us with cars), double the kilometres to track. Not to mention time lost! Limiting trips means limiting paperwork.

I also would encourage digital nomads to remember to get receipts and claim deductions for their networking. No, getting drunk with other bloggers and ranting about Facebook doesn’t exactly mean that you can write off a giant wine bar bill. But having a monthly coffee meet up to take turns helping each other with social media definitely does. I think a lot of bloggers and digital nomads thing that “networking” is something that boring people in suits do but the deductions apply to every profession

Hi Vanessa,

I too, get some sort of perverse pleasure from filing my taxes! Then again, I also track and publish my annual income and expenses; ever the financial planner I am! 😉

Great advice about networking expenses. In Canada, you can claim “meals and entertainment” expenses, which include things like taking a client out for lunch, meeting with colleagues over coffee, etc. Only about 50% of the expense is actually tax deductible, but basically if there’s a work-slant to your meal/entertainment expense, it’s worth logging for taxes.

Oh my gosh – what a great guide! Thank you for putting all the time into writing this. I an always looking for ways to do better on tax related info and this will be a great guide to keep referencing.

For anyone else reading this comment, I can echo what Nora is saying, just file, file, file every year, even if you know you don’t owe taxes. For any US citizens perhaps earning income in multiple states, we now file (personally we choose to use the paid version of HR Block and they offer some great free assistance if needed) in every state we made income. We didn’t do this one year and it automatically triggered us for an audit – which we didn’t know/think it would. It was such a huge amount of time to get it all taken care of, eventually it got sorted, but we never want to do that again!

So anyway, thank you Nora! I will reread this post a few times! Cheers!

Hey Tiff,

I’m SO glad you like this resource! I plan to create a few more super-comprehensive resources in the not-too-distant future; stay tuned!

I’m curious; when you say you file in every state where you earned income, are those all separate tax returns you’re filing, or a separate form for each state that goes in with your overall return?

We file for EACH state we worked in. So usually that means we file our federal taxes, our NY State taxes (where our permanent address is – even tho we earn $0 dollars in NY) and VT State taxes (where all our W-2’s come.) We got audited one year because not filing our NY taxes just made us an automatic red flag (so I was told) because of the address issue.

We use HR Block and because of some of the forms I get, we need to pay for the first or second tier of their pricing system (there is a completely free option that many ppl can use), then pay to file NY state and pay to file VT state. All in all it comes to about $100 usd to file.

I think I could definitely be doing “better” things to help myself out tax wise, but I do try to learn a little bit more about it every year. So this was a great post and an easy to digest manner – thanks again! 🙂

Thanks for the clarification, Tiff! Seems like a lotta paperwork, but $100 is totally reasonable after all is said and done!

Wow very nice work.. you put a lot of time into this.. I hope to be a digital nomad soon and I saved this post and will definitely study it! Thanks so much for taking the time and writing this! Take care and safe travels

Thanks, Dustin! Happy tax planning! 😉

Here in Romania we don’t deduct things as the tax is based on the income earned, so whatever enters the company we pay 2% to the state…

Anyway, thanks for the comprehensive post, great job!

Thanks for the info, Codrut! Very interesting. I guess 2% is a pretty reasonable rate to pay; no need for deductions!

Hey Nora,

Thanks so much for such a comprehensive guide! You’re right, taxes as a digital nomad is an often asked yet rarely properly answered question, so I really appreciate you taking the time to do so.

I have a bit of a follow up question to your guide…so as a Canadian blogger, does one need to claim their blog to the CRA right away, gain a Business Number, or anything of the sort? Or do you just blog away, track all your expenses and incomes, and then consider yourself as “self employed” for tax purposes? That’s always the part I get worried about, that I’m meant to be officially claiming my site with the government BEFORE taxes or something…

Thanks again for the great post!

Hi Brianna,

In general, you can operate a blog as a “sole proprietor” which doesn’t require you to do anything special (no business numbers, etc).

And in general it’s best to start claiming your income and expenses right away; in the early years of starting many businesses/blogs, expenses exceed income, and those expenses can be deducted from your TOTAL income for the year (for example, if you have income from a day job), which often means a juicy tax refund!

Be careful however, because CRA is leery of “hobby businesses” and if you run a deficit for too many years, they may audit you. At some point you are expected to turn a profit! Otherwise, they may accuse you of creating a fake business just for the write-offs.

As always, please double-check my advice – I wouldn’t want to mislead you and get you into hot water. CRA may have changed their regulations since I my financial planning days.

Thank you so much for this article. It has good information.

I’m a Canadian, non-resident determined by CRA, I have a digital agency working from Central America. If I have a Canadian Client who pays me via Paypal, do I have to declare taxes on that money I’m getting from a Canadian source?

Hi Veronica,

Where do you currently file taxes? Do you file taxes in Canada at all? (I assume not). Generally speaking, you are supposed to claim your worldwide income on your taxes – in the country where you are a resident.

I earn income in various currencies from people in various countries; my responsibility is to claim all this income on my Canadian return. I assume the same would be for you, filing your worldwide income on whatever tax return you file.

I’m not a tax expert, so please check with an accountant or tax preparer.

Hello! Thank you very much for this guide, very helpful!

I have a question, not sure if you can help but I will try 🙂

I am an Italian national, living in Thailand as a student. My online work is mainly with the UK. I am a bit confused as where I am supposed to pay taxes, should I register myself as self-employed in my home country and pay taxes there or should I file them in Thailand as I live here?

Thanks in advance!

Hi Alessia,

That’s a difficult question to answer, as I’m not familiar with the requirements of your Thai visa as well as your residency policies in Italy. I would suggest speaking with an accountant in Italy, who should be able to answer these questions.

That’s a very nice article. I read the Canadian (CRA) section and it seems in-line with my understanding as a CPA without specialized knowledge in taxation for digital nomads.

I’m currently a full-time employee working in Canada for a Canadian company, about to embark on a digital nomad journey sometime next year. I began to think about my tax strategy and concluded to this:

– It would be very difficult / impossible to claim that I’m self-employed, even if contractual changes were made between me and the company, unless I get other income streams as well. So I’m not exploring that route

– I won’t file as non-resident for tax purposes as well because there are residential ties (car, house) I can’t get rid of

– I’ll ask for a T2200 form from my employer where they will state that I’m required to take on certain expenses as part of my employment (supplies, cell phone, coworking space) that will not be reimbursed

Still lots of research to be done, but it’s an interesting tax area. Ultimately we have to look at case law to see how CRA interprets employment expense/self-employment expense rules, which were not at all written with the concept of digital nomad in mind.

Great input, Tony!

Yes, you can alter your agreement with your employer such that you are a contractor for them rather than a full employee (I believe this is what the T2200 indicates).

This allows you to deduct any expenses you incur that can be related to your work (office supplies, phone, co-working space, etc) as well as your health/medical plan and more. It’s pretty much a self-employed situation, except you have a contract.

It can be very profitable in terms of tax deductions, and is well suited to a digital nomad lifestyle. The biggest drawback is that as far as I know, with this arrangement, the employer is not beholden to you as an employee in the same way regarding benefits, job security, etc. They can let go of you with not notice or severance if they wish.

Actually, that’s not exactly correct, based on my experience as a Canadian CPA.

T2200 is actually REQUIRED in order for an EMPLOYEE (not self-employed contractor) to claim any kind of employment expense (cell phone, home office, etc.) CRA requires that you to keep it in case of audit but doesn’t require you to file it during the tax return, which is why many people don’t ask for it from their employers. In practice, whether or not CRA will actually deny reasonable employment-related expenses without a T2200 is up to them. I would suggest just getting one, to be in-line with the law. It’s usually easier to deal with HR than being audited by CRA.

Regarding employee vs. self-employed, CRA will look at more than just what’s written on paper. Even if the agreement between a company and an individual is on a contractor basis, CRA could take the stance that it was “in essence” an employer/employee relationship and deny certain expenses. The web has many good articles on that topic. However, I don’t think being self-employed vs. employee actually yields a tax benefit for most people, as the kind of expenses you’re allowed to deduct as a self-employed individual vs. what’s allowed as an employee include things like mortgage interest and advertising/promotion. Everything you mentioned in your article can be deducted by both employees and self-employed individuals.

Check out this comparison table: https://tkl-files.s3.amazonaws.com/Employee-vs-commissioned-vs-selfemployed.png

All that to say that for someone switching from being employed in Canada to working remotely somewhere else for the same company, getting a T2200 that says the employee is required to bear XYZ expenses is probably the safest/most kosher way of doing it. Alternatively, you can represent yourself as self-employed contractor, but then will need to be a little more cautious because it can be challenged if case facts point to an employer-employee relationship.

Such fabulous information. Thank you, Tony!

Hello!

Thank you for the article. I see a huge emphasis on self employed or contractors, but how about salaried employees?

I work in Canada and my job is done remotely. I would like to keep same job but work from some Eastern European countries.

I read that you get more or less taxed based on your residency situation (6 months rule), I am unclear on how to avoid duplicate tax payments from home (canada) and host countries (EU)

1. If I stay 6 months in a European country, will I get taxed from there and in Canada?

2.

Because I am salaried, it looks like my employer has an obligation to deduct taxes in canada..am I right?

In summary, I just want to find the easiest way not to be double taxed and also not to make my situation difficult for my employer (since technically it’s my choice to work remotely)

Hi Siena,

Great question, and one that will become more and more prevalent as the pandemic has necessitated salaried employees to work remotely, and it’s a trend that’s not likely to reverse.

First of all, my advice is not official. I recommend you consult with an accountant who is familiar with international tax law and burgeoning remote work legislation.

However I can tell you what I did as a Canadian who traveled abroad, and I believe it may apply to you as well.

As long as you are not cutting ties to Canada (as in, you maintain bank accounts here, etc), then you are a “factual resident” of Canada even if you’re not present the whole time. This means you need to file a Canadian tax return (reporting your worldwide income) and pay tax accordingly.

If you stay for 6 months in a European country, I don’t believe that makes you a resident of that country. But this also depends on the type of visa that you have. More and more countries are offering visas specific to remote workers; I’m sure the terms of their visas will stipulate what needs to happen and how you would be taxed (if at all).

Even if you are considered a resident, Canada has tax treaties with many countries to ensure you are not double-taxed. You may need to file a return in both countries, but you won’t be taxed twice.

For myself, I never stayed in one place long enough to be considered a resident. And this is something you could do as well.

Thank you! Happy holidays to you!

You are very thoughtful and appreciate so much your answer!

I have a French passport, so I don’t need a visa for most countries in Europe

I will indeed keep my bank accounts in Canada and maybe the answer is like you said filing in both countries but only pay in Canada

Are you still traveling during the pandemic? Do you have a list of your favorite places to work remotely from?

If there is an alternative way to contact you, let me know so I don’t disrupt the comment section flow

Thank you

Hi Siena,

Glad I could help. No, I’m not traveling during the pandemic; I have a home base in Toronto, where I’ve been since March.

You can reach out to the email address on my contact page: https://www.theprofessionalhobo.com/contact/

Hi Siena and Nora,

I am basically on the same situation. I work remotely in Canada for a company in the US as a salaried employee. I pay Canadian taxes now but I am planning in leaving Canada permanently in September and go to Thailand and marry a Thai girl. My accountant told me I have to advise CRA when I leave Canada that I will be an Emigrant. And my resident status will change to Non-Resident for taxes purposes as my main ties will be in Thailand. I will keep my bank account and will receive salary still in my main debit card in Canada.

So I assume my company will not be deducting taxes anymore from my income and once I am in Thailand I will have to file tax return there? I’m not sure how that will work. Does anyone have any insight?

I also believe that Thailand and Canada have a tax treaty agreement.

Let me know if you have any information,

Thank you,

Felipe

Hi,

Nice article.

What happens if you work for one of the online freelancing portals and live and slow travel abroad in a country or a few countries? Those online freelancing portals are not based in those countries abroad. Do you just file an American tax return? If the foreign countries require you to file a local tax return wouldn’t that be strange because technically you don’t work for companies registered in those overseas countries and you don’t pay local taxes regularly through paycheck deductions, you would just have a tourist visa, in some cases even a visa is not required to enter a country, etc.?

Thank you.

Hi Ivan,

Great questions! I think at least some of your questions will be answered in this more recent article about working remotely from a tax perspective: https://www.theprofessionalhobo.com/tax-consequences-of-remote-work-visas/

But in short, you don’t need to file taxes in the country where the online portals/employers are based if you aren’t resident/citizen there.

For the countries you are physically present in, whether or not you have to file there depends on the visa you have, but in most cases you will not need to file taxes in that country. (If you have a tourist visa you will never be required to file taxes in that country; the only grey areas are if you have business/remote work visas, and even then, in most cases you needn’t file).

Simply keep filing a U.S. tax return, and claim your worldwide income on it.

I am Canadian and set-employed; however, most of my income is earned through one client. I have a contract to work so many days a month with them but am not considered an employee. I would like to work remotely from the UK for about 3 months. Would I require a visa to continue my self-employment while residing in the UK. I have found so much conflicting information regarding this.

Thanks for any info you can provide,

Andrea

Hi Andrea,

It’s a huge grey area. Prior to the pandemic, there was no proper visa for self-employed remote workers. Business visas were for people intending to do business at the destination (which remote workers don’t generally do – they work for foreign employers), but tourist visas were often pretty explicit about not being for work.

Thus, self-employed remote workers simply traveled on tourist visas for lack of any other option.

That’s what I did and I don’t feel bad about it at all; I earned money from foreign sources and I spent it locally. What country wouldn’t want me to be there?!

Now that millions upon millions of people’s jobs have been made remote and dozens of countries want to entice these people to come and stay for a while, special visas for remote workers have been invented.

This is probably why you’re seeing conflicting information, and to be honest it’s still a moving target.

To get the most accurate and up to date info, check the local country’s immigration website (in your case the UK site). https://www.gov.uk/government/organisations/uk-visas-and-immigration

Hope this helps.

Hi,

Thanks for sharing all this information!

I am riding my bike around the country (Canada), and am essentially homeless, so no address to speak of. Do I need to file for a specific province? How does that work?

Thank you!

Hi Gertrude,

Do you have a driver’s license? A health card? Whatever province those are enrolled in is your province of residence for tax purposes.

Hope this helps!