Are you planning to go on a long-term trip to a foreign country? As a digital nomad or remote worker, you need to have travel medical insurance; not only is it a good idea – it’s downright necessary to qualify for certain visas and enter certain countries.

Without the right insurance, the wrong emergency can turn your entire trip into an exceedingly expensive and disappointing experience. Long stay travel insurance will ensure that you return home without any problems.

The entire travel insurance industry was shaken up by the pandemic, and although we are all finding our feet again, finding the best travel insurance in 2024 for a long-term trip is no longer as clear-cut as it once was. You require flexibility, affordability, and of course, travel insurance that covers COVID and other pandemics.

Links in this post are affiliate links, which means I will receive a commission if you click through and end up making a purchase. Having endured travel insurance emergencies myself, I know the pitfalls, and I am writing this article to help readers find the best solutions and navigate the murky waters of world nomads insurance.

Looking for The Best Travel Insurance Companies

Finding the best travel insurance coverage means using a travel insurance company that will make your trip abroad a smooth one. Aside from the main things like medical and health insurance that will greatly benefit you if you encounter any illness or injuries, simple things such as lost luggage or cancellations and interruptions are important to consider too.

What Long-Term Travelers Need in a Travel Medical Insurance Plan

Long-time digital nomads are well familiar with the unfortunate limitations of the international travel insurance industry due to their unique requirements. Here are a few criteria to keep in mind when getting a travel insurance plan:

Ability to Apply / Renew From Anywhere

Most travel insurance companies will only allow you to apply for a policy whilst in your home country. This is completely impractical for a digital nomad or remote worker traveling long term.

Long Term Policies

Most travel insurance policies expire after a certain period (somewhere between six months and one year) after which you can’t extend or renew.

Home Country Coverage for Visits Home

With most policies, you won’t have any coverage if something happens while you’re visiting your home country. And if you’re a long-term traveler, your provincial/national medical coverage may also have expired. (Canadians are familiar with this; once you are absent from your province for a certain amount of time – usually around six months – you have no medical coverage).

Travel Insurance Coronavirus Coverage

Does travel insurance cover coronavirus? Of the very few insurance companies left out there that satisfy the criteria above, many still don’t cover claims related to COVID – or if they do, their fine print is so ambiguous it gives them enough leeway to deny claims as they see fit. And even if they cover a medical claim on the contraction of COVID or any other pandemic illness, they may not cover a mandated quarantine and related expenses.

Where Do I Get Travel Medical Insurance

This leads me to Safety Wing: an insurance company developed by nomads, for nomads. This doesn’t mean it’s a fly-by-night operation; far from it. Their policies are underwritten by Tokyo Marine HCC, financially rated as an A++ company (which means they have the financial stability and cash reserves to pay out on claims).

SafetyWing offers three insurance products specially designed for remote workers and remote companies. It’s one of the top travel insurers for nomads that offers legitimate medical plans and insurance.

Here are a few features offered within the full suite of SafetyWing products:

- Visits home are covered. You’ll have coverage for visits to your home country of up to 30 days for every three months (for U.S. citizens it’s 15 days).

- You can purchase and renew from abroad.

- They will cover claims related to COVID-19; it works the same as for any other illness.

SafetyWing Nomad Insurance: International Travel Medical Insurance for Remote Workers

SafetyWing Nomad Insurance is an international travel medical insurance policy. This means it is intended to help you pay for unexpected medical problems and accidents while abroad. You may want to reference this article on what travel insurance is, which includes a glossary of insurance terms.

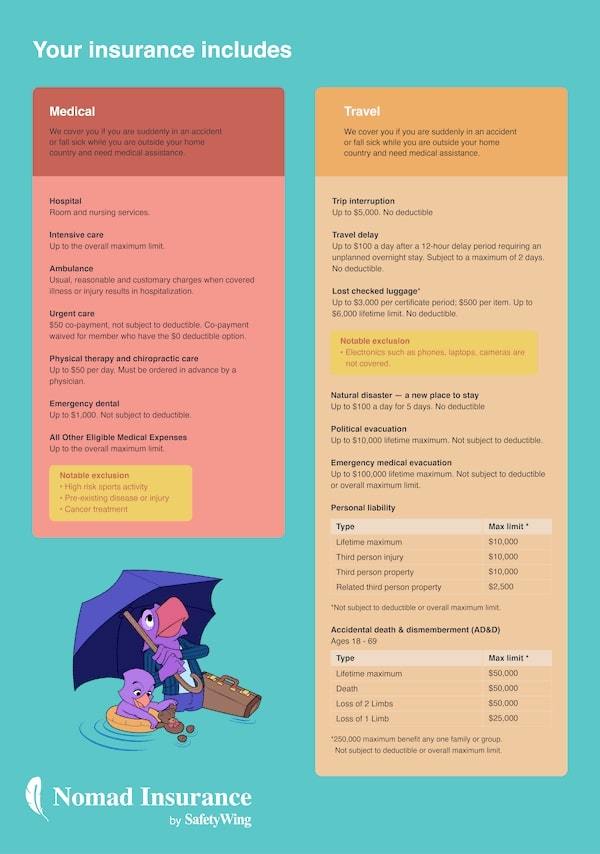

Nomad Travel Insurance policies include coverage for:

- Doctors (specific visits, not routine checkups)

- Hospitals and ambulances

- Emergency medical evacuation

- Emergency dental

- Physical therapy and chiropractic (as prescribed by a physician)

- Trip interruption

- Travel delay

- Lost checked luggage

- Emergency response and natural disasters

- Personal liability

- AD&D (Accidental Death & Dismemberment)

Click here to get your instant quote for Nomad Insurance!

Nomad Travel Insurance: PROS

Prices are super-competitive, starting at $45/four weeks for people aged 18-39…as long as you select coverage that excludes the United States (including the United States almost doubles the price).

For trips of unknown or long-term duration, you pay monthly and the insurance automatically renews each month until you cancel. So if you’re trying out long-term travel but don’t know how long you’ll be gone for, this is perfect! If you already know your travel dates, you can enter them in and pay for the entire policy up front.

Once your policy hits one year, you can apply again for a new policy, and there’s no limit to the number of times you re-apply (up to the age of 69).

It’s a nice low deductible at $250.

You can apply for and renew the policy from anywhere in the world.

While the policy has a “pre-existing clause” (which excludes coverage for any condition which existed in the two years prior to applying), they DO have an “acute onset” clause that covers pre-existing conditions that unexpectedly flare up without warning, are of short duration, and require urgent care within 24 hours.

Children 10 years and younger are included at no extra cost (1 child per adult, 2 per family).

In addition to COVID medical coverage, Nomad Insurance covers quarantine expenses of $50/day for up to 10 days (provided you’ve had coverage for a minimum of 28 days, you’re outside of your home country, and the quarantine has been mandated by a physician or governmental authority because you tested positive for COVID-19 or had symptoms and are awaiting test results).

Nomad Medical Travel Insurance: CONS

While a $250,000 maximum coverage limit is reasonable in most countries, it won’t go as far in the U.S. And paying double the premiums for these low maximum bites.

Great news: If you are a U.S. citizen and get a policy that excludes U.S. coverage, you still qualify for coverage on visits home! (15 days every three months).

Because you need to reapply for a new policy every 365 days, that means the pre-existing clause resets every year (meaning you will not have coverage for any pre-existing conditions that predate the new policy by two years). With most long-term nomads’ travel insurance policies, you only need to endure this clause once. While I’ve listed this as a “con”, it’s a double-edged sword; many long-term medical travel insurance policies require you to undergo a medical questionnaire, which requires you to disclose all medical conditions you’ve suffered at any time in your life. Quite often this will result in a blanket exclusion of that condition, even if it was many years ago. Nomad Insurance requires no medical questionnaire; so with a pre-existing clause that resets every year, once you are two years past any condition, they will cover it again.

There is no coverage for people above the age of 69, and the coverage limit for people aged 65-69 is reduced to $100,000.

Check out the widget below to see how much your SafetyWing Nomad Insurance will be!

Final Note: As a Canadian who traveled full-time for 12 years, I was unable to qualify for standard travel insurance after my first year abroad (because I’d lost my provincial coverage, which travel insurance companies rely on). Thus, I was forced to get more expensive health insurance for expatriates, which frankly, wasn’t an ideal product for what I wanted – I simply wanted coverage for medical emergencies. I structured the policy to have an incredibly high deductible of $2,500 (to reduce my monthly premiums), such that it would only be useful in the event of an expensive medical emergency.

SafetyWing coverage is not based on the requirement for provincial coverage, which makes it a simple and cost-effective solution if you are a Canadian in a similar situation.

Types of Travel Medical Insurance Plans (in General)

Not related to Safety Wing, here are the three general types of travel medical insurance you can get:

International Medical insurance for a single trip: This is the most popular insurance plan and is used when you’re going on a single trip that covers your entire stay.

Multi-trip International Medical (Annual plan): This provides international medical insurance coverage on a yearly basis that covers numerous trips a year (the policy will have terms for how many trips you can take and/or how long each trip can be).

Visitor Travel Medical insurance: This type of plan offers coverage for short-term visitors to the USA.

Safety Wing Not the Best Option for You? Get Other Insurance Quotes Here

I’m a big believer in getting multiple quotes and comparing different policy options each time I take a trip. For example, on my latest trip, I planned to spend the winter skiing. I discovered insurance companies provide VERY different options regarding what kinds of skiing-related accidents they cover! This is NOT something you want to find out while you’re on the slopes.

So, here are a few more options for you to explore:

Genki offers both travel health insurance and international health insurance for digital nomads and long-term travelers, and is the insurance company I chose for my most recent four-month trip. The cost was the same as Safety Wing, however the coverage amounts are unlimited and the sports coverage is more robust.

🌏 Worldwide. Genki covers care in every country. Available to citizens of any country.

📆 Flexible monthly subscription. No long-term contract. Cancel anytime.

📱 Easy to sign-up (and cancel) in minutes, all online, from anywhere in the world.

What’s included?

- Reimbursement for medical treatment with almost no cost limits. Direct billing to any hospital. Telemedicine included.

- Choose your doctor. Genki covers treatment at any locally authorized healthcare provider.

- 24/7 medical assistance hotline. Medical rescue & transport.

Visitors Coverage is an insurance broker that will give you multiple quotes and match you with the best policies depending on your needs, including age, trip length, and destinations.

Also, I have gotten a lot of emails from American seniors who have been dismayed at how many insurance companies either cut off or substantially reduce coverage for people over the age of 65. I have FINALLY found an insurance company that has no age limit for coverage! Travelex offers a few different travel insurance plans; their Travel Select plan offers coverage up to 364 days.

(Note: I don’t have personal experience with Travelex as it is only for Americans. Also, note that the coverage limits are quite low; if I were getting a policy from them I would spring for the Additional Medical Coverage upgrade).

Comment below if you found this helpful!

Hi Nora, You have shared very important information with us, we should definitely take travel medical insurance. Thank You for this amazing information with us.

I’m booking Safety Wing now mainly due to comprehensive cover and quick answers to questions on their chat which reassures me they’ll be responsive if anything happens

Hey Trudi,

I have a colleague who had to make a claim with Safety Wing and he said it was a very smooth experience. I hope you love them as much as I do! Happy travels.

Hi, Nora. Thank you for your articles. I wanted to get SafetyWing, as it looks such a great deal! But I’ve read so many bad reviews about it, saying that it is a scam, such as this one on reddit: https://www.reddit.com/r/digitalnomad/comments/wnkwl8/warning_worldtrips_aka_safetywing_insurance_is_a/. What do you think about it? Thank you!

Hi Diego,

I have more than one friend who has made successful claims through Safety Wing. It is not a scam.

The other concerns expressed in the reddit indicate the users are unfamiliar with how insurance works including how pre-existing conditions work, the use of underwriters, and the reality that indeed, when it comes time to make an insurance claim, the underwriter/insurance company is going to try to get out of it (partly a due diligence process to ensure they’re not getting scammed by users).

I’ve had to make insurance claims before, and they’re no cakewalk. But it doesn’t mean it’s a scam.

sorry this is not available for those of us over 69 years of age.

Thanks for weighing in, Sara. I’m researching some options and will create some content around this prevalent issue. In the meantime, I suggest checking out Visitors Coverage (listed above in the article). Thanks!